Enterprise Products Partners LP (EPD) is one of the largest midstream energy companies and Master Limited Partnerships in the country, with a vast portfolio of service assets connected to the heart of American energy production, observes Tom Hutchinson, editor of Cabot Dividend Investor.

Current assets include the following:

50,000 miles of pipeline

300 mmBbls of liquids storage

21 deepwater docks

45 natural gas processing trains

26 fractionators

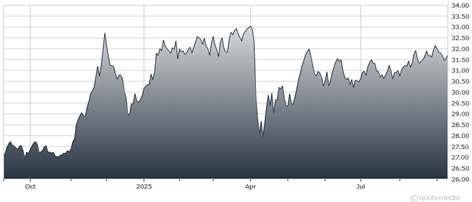

Enterprise Products Partners LP (EPD)

As a midstream energy partnership, Enterprise is not reliant on volatile commodity prices. It generates about 80% of revenue from fees for storing, processing, and transporting oil and gas. They collect tolls on the US energy highway at a time when production is likely to increase substantially.

The first thing that probably comes to mind when considering EPD is the distribution. EPD currently pays a $2.18 annual dividend, which translates to a 6.8% yield at the recent price. Is that massive yield safe?

As an MLP, Enterprise pays no income tax at the corporate level and pays out the bulk of earnings in the form of distributions. The payout ratio has been in the 65% to 80% range over the past few years, which is lower than most MLPs and enables the partnership to invest its own capital in growth projects at lower cost.

Enterprise is commonly regarded as having the best balance sheet in the midstream space, with low debt, high credit ratings, and a surprisingly low payout ratio for an MLP. The payout also has a stellar 1.7 times coverage with cash flow, one of the best in the sector. It’s also an MLP that has increased distributions every year for 27 consecutive years.

Recommended Action: Buy EPD.