Study how the market has moved over history, and you’ll learn that momentum will work against your best timing intentions every time. And remember: You – and your portfolio – are more resilient than you think, advises Callie Cox, chief market strategist at Ritholtz Wealth Management.

Since 1950, the S&P 500 Index (^SPX) – an index of the 500 largest public companies on US exchanges – has spent more time within spitting distance (2%) of record highs than it has in crashes (20% or more below record highs). Promise yourself you’ll buy when the stock market falls 10%, and you’ll be waiting an average of two years if history is any guide. And for much of that time, share prices will be rising, which makes buying back in more expensive.

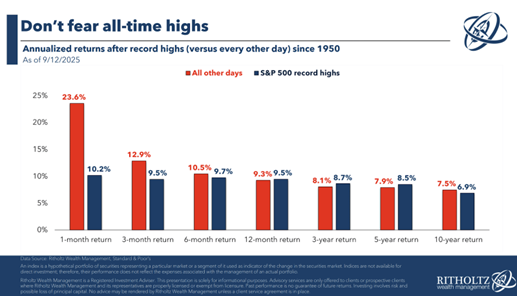

Moreover, if corporate earnings and the economy are growing, those record highs may be justified. Or, investors are sniffing out a new trend that hasn’t become obvious yet. Sometimes, markets just gather enough momentum to keep reaching new highs, regardless of how stable the ground feels beneath your feet.

This is what trips up a lot of experienced investors. They sell, convinced the market is about to fall off a cliff, and then can’t decide when to buy back in as prices move away from them. From there, it’s a psychological snowball. Trust me, I have conversations like this all the time.

Over the past 70 years, we've endured wars, recessions, political turmoil, financial crises, health crises, humanitarian crises, 13 recessions, and 11 bear markets. Still, over that timeframe, US stocks have delivered ~8% average annual returns.