Founded in 1929, American States Water Co. (AWR) is a utility company that operates primarily through two regulated subsidiaries, Golden State Water Co. and Bear Valley Electric Service, providing water and electric services in California. The company is benefiting from recent rate case approvals and policy tailwinds, supporting growth, notes Kelley Wright, editor of IQ Trends.

GSWC serves approximately 264,600 water customers across 80 communities in Northern, Coastal, and Southern California, while BVES distributes electricity to around 24,900 customers in the City of Big Bear Lake and surrounding areas in San Bernardino County. AWR also operates through American States Utility Services (ASUS), which provides water and wastewater services to various US military installations under long-term contracts.

(Editor’s Note: Kelley is speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

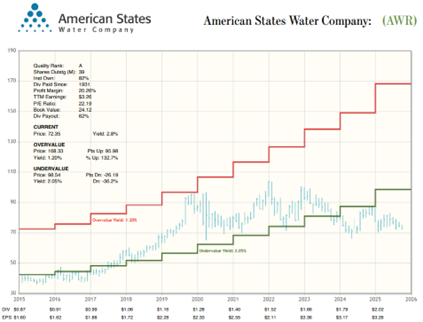

The company’s revenue is primarily derived from its water utility segment, accounting for approximately 70% of total sales, followed by its electric utility and contracted services segments. AWR benefits from a regulated monopoly in its service area, which supports stable revenue streams. The company has a strong dividend history, with a 71-year streak of annual dividend increases.

AWR’s growth is driven by infrastructure investments, rate increases approved by the California Public Utilities Commission, and the expansion of its contracted services. AWR’s impressive dividend history further enhances its appeal to investors seeking stable, long-term returns.

But rising capital spending and share dilution threaten per-share returns and earnings visibility. Growth may be too slow for certain investment strategies, with a preference for higher risk and faster growth prospects.

The ROIC, FCFY, and P/EBV are 6%, -2%, and 1.9 respectively. Economic Earnings are $0.38 vs $3.26 reported. Economic Book Value = $38.31 per share. Ten thousand dollars invested five years ago is now worth approximately $11,335.