Gold is on pace for its best one-year rally in almost fifty years, so it’s only natural to say that the rally could use a rest — and it could. But gold is a tricky asset at times. After flailing through the 1980s and 1990s, it went on a twelve-year win streak, gaining more than 500% in the process, observes Bret Kenwell, US investment analyst at eToro.

A price of $4,000 an ounce seemed far-fetched at the start of the year as gold entered 2025 near $2,800 an ounce. But after a rally of around 50%, here we are. Gold has benefited from multiple catalysts this year, including tariff uncertainty, stubborn inflation, and a falling US dollar.

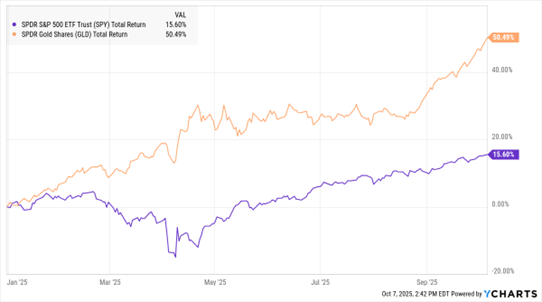

SPY, GLD (YTD % Change)

Data by YCharts

Uncertainty around the government shutdown and prospects of lower interest rates have only seemed to fan the flames of this year’s rally. While gold might be running hot now, investors should remember that it’s not just a 2025 story.

In fact, gold has outperformed the S&P 500 Index (^SPX) in four of the last seven years and is on pace to add another tally to the “win” column. That’s saying something too, with the S&P 500 working on its seventh double-digit return in the last nine years.

For perspective, gold is working on a three-year win streak with a gain of around 120%. If the long-term catalysts remain in play, gold may have more room to run in the years ahead.

Earlier this year, eToro’s quarterly survey of retail investors found that 57% of investors expected gold prices to increase in the short term, with 42% of retail investors currently invested in the asset. Further, a majority of retail investors (58%) had already or planned to adjust portfolio allocations given the prospect of a weakening USD by investing more — specifically in gold (31%) and cryptoassets (26%).