Why do we remain bullish on technology? Concentration during transformative periods is normal. I have drawn an analogy to the 1990s for almost four years. We saw the opportunity, and we have argued that today's technologies are significantly more robust than the Internet revolution, says Nancy Tengler, CIO of Laffer Tengler Investments.

In August, I asked my team to look at previous transformative periods in our history as a nation. This was prompted by the pundit drumbeat that the market was too concentrated in a few names and that valuations were lofty.

(Editor’s Note: Nancy will be speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

I have been managing money since the mid-1980s. I knew from memory that the dotcom boom was led by the Four Horsemen (today, the bearish pundits would cite the Magnificent Seven). Valuations? Well, Cisco Systems Inc. (CSCO) exited the 1990s trading at 100x peak earnings. Today, Alphabet Inc. (GOOGL), for example, is trading at 25x estimated earnings – which are still expected to grow handily.

How has the market handled other transformative periods? We went back to the Second Industrial Revolution. Our analysis begins in the 1890s (with a particular focus on the early 1900s) since the Dow Jones Industrial Average was introduced in 1896:

- Railroads represented approximately 60%-70% of total US market cap and remained a significant concentration during the first decade of the 1900s at 60% of market cap.

- Industrials drove the focus in the DJIA in the 1900s and 1910s as the economy concentrated on heavy industrials and manufacturing. Steel, autos, and chemicals dominated.

- The Industrial Revolution continued to dominate the DJIA and eventually the S&P 500 Index (^SPX) after it was introduced in 1957.

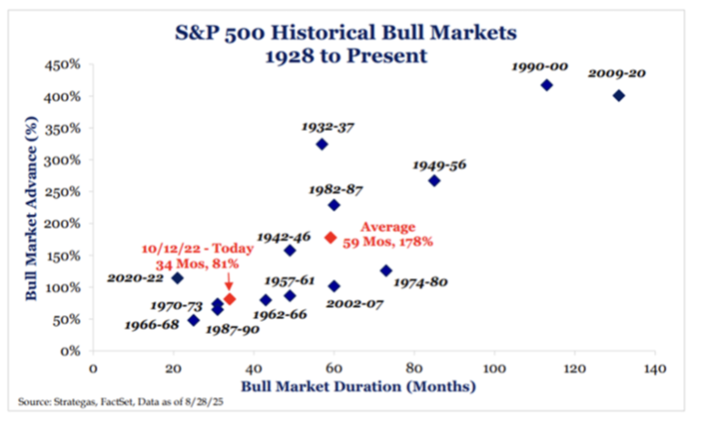

Bottom line? We believe we are still in the early buildout and usage of these new, transformative technologies. We also believe we are in a secular bull market. That does not mean we won't experience a correction in the coming months. But if so, we will react as we did in the spring, adding to the highest quality names at bargain prices.