Nordson Corp. (NDSN) was founded in 1954 in Ohio, but the company can trace its roots back to 1909 with the US Automatic Company. Today, it has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, advises Ben Reynolds, editor of Sure Passive Income.

Applications range from diapers and straws to cell phones and aerospace. On Aug. 20, Nordson reported third-quarter results for the period ending July 31. Sales were $742 million, 12% higher compared to $662 million in Q3 2024, driven by an 8% positive acquisition impact, 2% organic sales increase, and 2% favorable forex translation.

The Industrial Precision, Advanced Technology, and Medical and Fluid Solutions segments saw sales increase by 1%, 17%, and 32%, respectively. The company generated adjusted earnings-per-share (EPS) of $2.73, a 13% increase compared to the same prior year period. The company’s backlog declined 5% sequentially due to strong shipments.

On Sept. 2, Nordson completed the divestiture of certain product lines within its medical contract manufacturing business to Quasar Medical. The divestiture will allow the company to focus on other areas deemed more important for future growth, such as medical and fluid solutions.

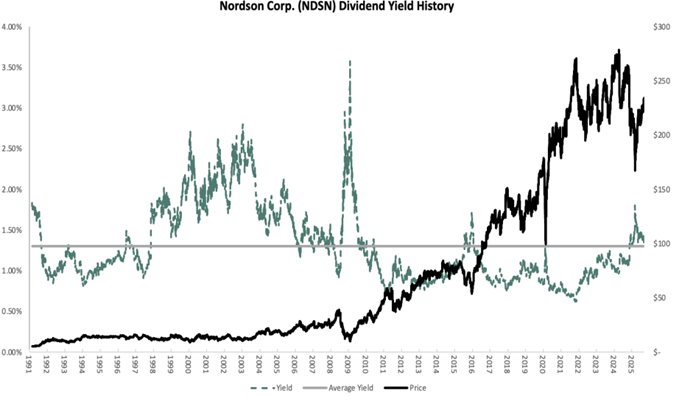

Nordson has raised its dividend for 62 consecutive years. This is one of the longest dividend growth streaks in the investing universe. Thanks to the low payout ratio of 32% expected for 2025, its strong balance sheet, and its growth prospects, Nordson is likely to keep raising its dividend for the long run.

Recommended Action: Buy NDSN.