Southern Copper Corp. (SCCO) is one of the world’s largest integrated copper producers, with a history dating to 1952. We believe the outlook for copper prices remains favorable. This backdrop supports a robust growth trajectory for SCCO, highlights Doug Gerlach, editor of Investor Advisory Service.

Its current structure emerged after Grupo México became the majority shareholder in 1999, followed by the 2005 consolidation of its Peruvian and Mexican assets. Today, its core business involves mining, smelting, and refining copper in Mexico and Peru, offering investors exposure to demand from global electrification and the energy transition.

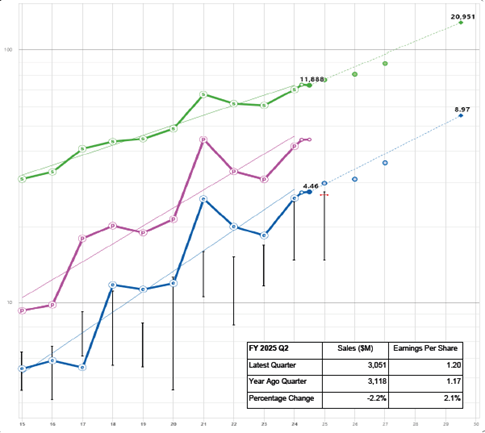

SCCO Sales, Earnings, Price Chart

The explosive growth of AI is a significant new demand driver for copper. More energy intensive than traditional facilities, AI data centers rely extensively on copper for their power and cooling infrastructure due to its superior conductivity. This demand is layered on top of the already copper-intensive global transition to clean energy, driven by the shift to Electric Vehicles (EVs), which use two to three times more copper than conventional cars, and the build-out of renewable energy infrastructure like wind and solar farms.

The long-term supply of copper is constrained. Average copper ore grades have declined by approximately 40% since 1991. This forces producers to mine and process significantly more rock to yield the same amount of copper, which in turn drives up capital intensity, energy consumption, and operational complexity.

Southern Copper maintains a strong financial profile, characterized by high profitability, robust cash flow generation, and a solid balance sheet. The company has a long history of paying quarterly dividends, which were traditionally distributed entirely in cash.

We model a 15% annual growth rate in earnings per share driven by a combination of rising copper prices and increased production from the company's project pipeline. If achieved, this growth could drive EPS to $8.97 within five years.