As of last Friday, the Atlanta Fed’s GDPNow model pointed to 3.9% GDP growth in the current quarter, while their tally of the top 10 forecasting services sees 2.5% growth. If anything threatens to impede growth this quarter, it could be consumer and business sentiment, observes Louis Navellier, founder and chairman of Navellier & Associates.

The federal government shutdown is expected to impair consumer confidence a bit. But since government tends to impede productivity, the shutdown may actually be a plus.

Still, the National Federation of Independent Business said last Tuesday that its optimism index, a gauge of sentiment among small firms, fell by two points in September to 98.8. Economists expected sentiment to hold steady at 100.8, so the drop in sentiment came as a surprise.

(Editor’s Note: Louis will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

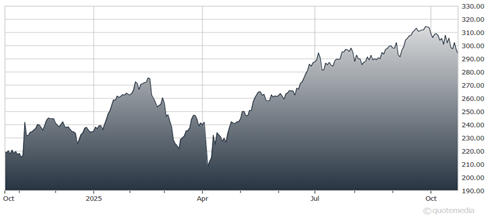

JPMorgan Chase & Co. (JPM)

Approximately 64% of small business owners said that supply-chain disruptions were affecting their business to some degree. But the index’s uncertainty component rose seven points in August to 100, the fourth-highest reading in more than 51 years. If business sentiment falls, this small business caution could impede fourth-quarter GDP growth.

On the other hand, third-quarter announcement season is off to a great start, with major financial institutions reporting better-than-expected results. JPMorgan Chase & Co. (JPM) CEO Jamie Dimon said the US economy remained resilient despite some “signs of softening, particularly in job growth.” Dimon also said that the economic impact of tariffs “have been less than people expected, including us,” adding that the final outcome of the new tariff negotiations has yet to be seen.