Headline inflation came in below economists’ expectations on Friday, giving risk-on assets like stocks and crypto a boost. Investors gained confidence in not just an interest rate cut this week from the Federal Reserve, but in getting another cut in December, notes Bret Kenwell, US investment analyst at eToro.

To be fair, it would have taken a shockingly bad report to derail an October rate cut. But at a time when economic data is a bit sparse, investors will take any clarity they can get.

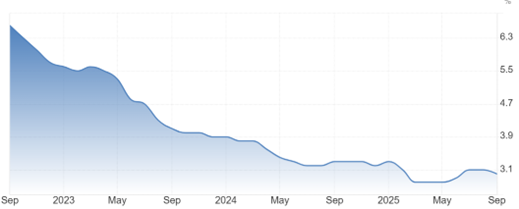

Core Inflation (YOY % Change)

Source: Trading Economics

While headline inflation may have come in below expectations, a year-over-year Consumer Price Index reading of 3% was either flat or higher for the fifth straight month. It also matched its highest figure of the past year (January 2025). Core CPI, which strips out some of the more-volatile components like food and energy, has not seen as aggressive of a rebound from the second-quarter lows. But it is broadly higher nevertheless.

Services inflation — which accounts for more than 60% of the report’s weighting — actually hit its lowest level in several years, though goods inflation hit its highest level since May 2023. Rising food and energy prices also put upward pressure on the report, something that could weigh on lower- and middle-income consumers.

While we may in fact get two more rate cuts this year, the Fed will struggle to justify a more aggressive rate-cutting approach in the face of stubbornly high inflation. Regardless, stocks can do well in a mildly inflationary environment, as we have seen over the past few years. We’ll need to see strong earnings, and so far this earnings season, that’s what we’ve gotten.