The term “circular spending” can refer to two very different concepts: A potentially misleading and problematic financing technique in the business world, or a macroeconomic model for how money flows through an economy. This term has been brought up a lot lately - with reference to its less-than-positive version, writes John Gardner, founder and principal of Blackhawk Wealth Advisors’ Market Insights.

Recently, discussions of circular spending have caught my attention almost daily as they relate to the veritable frenzy of spending in Artificial Intelligence (AI). Global AI spending is projected to approach $1.5 trillion in 2025 and maybe $2 trillion by 2026. This includes enterprise spending on AI services, software, and infrastructure.

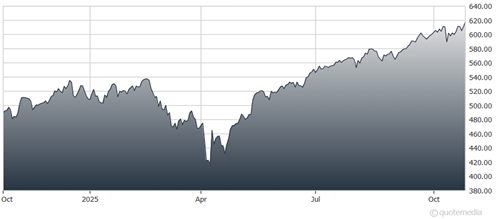

Invesco QQQ Trust (QQQ)

Here is a simple idea of how circular spending works in a potentially unsustainable way between two companies: Company A invests money in Company B. Company B then uses that money to buy products or services from Company A. This round trip of cash makes it appear that both companies have healthy, growing businesses, but it is not based on real demand or outside customer spending.

This business-to-business practice was a hallmark of the dot-com bubble of the late 1990s and early 2000, where telecom companies and Internet startups inflated revenue figures by buying services from one another. When the bubble burst, many of these companies collapsed.

That memory has many old Wall Streeters, like me, a bit concerned. The fact is there have recently been major investments by tech companies in AI startups, with the startups in turn purchasing a large amount of hardware from their investors. Different? We won't know how the surge in investment, enthusiasm, and euphoria in the new technological revolution ends until it ends.

The great 1990s dot-com bull market bubble popped only after investors lost control of rational behavior - when it was thought that no price was too high. We are not there...yet.

Subscribe to Blackhawk Wealth Advisors’ Market Insights here…