Since 1945, the S&P 500 Index (^SPX) has recorded the best two-month price increase and frequency of advance (FoA) in November and December, rising an average of 3.1% and posting a 76% FoA. Despite a possible short and shallow digestion of recent gains, we continue to see share prices advancing through year-end, remarks Sam Stovall, chief investment strategist at CFRA Research.

This year has been unique since October’s return marked the sixth consecutive monthly gain. Since 1945, the S&P 500 has never recorded such a stretch leading up to the final two months of the year. However, it has recorded such a run through prior months of the year 24 times.

(Editor’s Note: Sam will be speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

What’s more, the average performance in the two months following these six-month stretches was equal to that for all 960 two-month periods. As a result, history reassures investors that the market’s previously impressive pace should not detract from its typical end-of-year run – or in other words, not steal from Santa.

We think 2025 will be no different. We continue to see share prices advancing through year-end on an improvement in earnings growth expectations, a further lifting of trade barriers, an end to the government shutdown, and another rate cut in December.

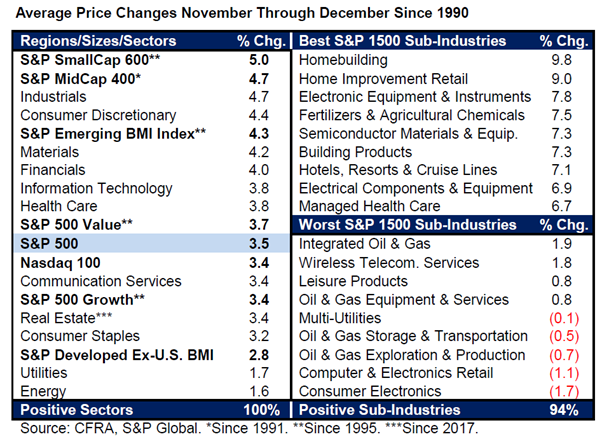

With such a strong showing in November and December since WWII, it should come as no surprise that all sizes, styles, and sectors posted positive returns on average during these final two months of the year. Leadership was typically seen in the mid- and small-caps, along with the consumer discretionary, industrials, and materials sectors. The defensive consumer staples, energy, real estate, and utilities groups tended to lag.