We are raising our intermediate-term rating on Super Micro Computer Inc. (SMCI) to “Buy” from “Hold.” In our view, missteps by the company on revenue delivery and margin shortfalls are fully reflected in the share price, while the potential for strong forward momentum is being overlooked, writes Jim Kelleher, analyst at Argus Research.

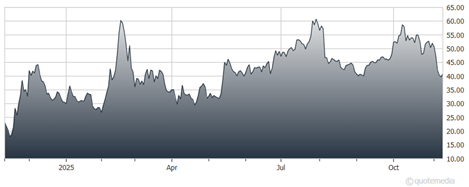

Though up more than 50% year-to-date recently, SMCI trades at less than half peak prices above $110 dating from early 2024 (all numbers adjusted for SMCI’s 10-for-1 stock split). Our long-term rating remains Buy. SMCI fell 5% in a rallying market on Nov. 5 after the GPU and CPU server company posted fiscal 1Q26 revenue and non-GAAP EPS that missed Street forecasts.

Super Micro Computer Inc. (SMCI)

Sales were well below initial guidance and represented a third straight revenue miss. That followed sales and profit shortfalls for fiscal 3Q25 and 4Q25. Non-GAAP EPS missed consensus expectations and declined 52% year-over-year.

Late in October, Super Micro informed investors that design win upgrades pushed some expected fiscal 1Q26 revenue into the second quarter. That resulted in 1Q26 revenue of about $5 billion, versus initial guidance in the $6 billion-$7 billion range.

Reflecting capture of that pushed out revenue as well as demand momentum, management forecast fiscal 2Q26 revenue in the $10 billion-$11 billion range, or $2 billion-$3 billion more than the pre-reporting consensus. With regulatory and compliance issues mainly behind it, Super Micro is now operating in an intensely competitive environment for GPU servers and AI data centers.

Recommended Action: Buy SMCI.