The combination of expanding investment opportunities and elevated funding costs have compelled Northland Power Inc. (NPIFF) to cut its payout by 40% to a new annualized rate of 72 cents Canadian. But the negative reaction to Northland’s news looks hugely overblown, advises Roger Conrad, editor of Conrad’s Utility Investor.

Incoming management gave no previous indication of a downshift in dividend policy. And the company was covering its payout with free cash flow (1.7X in Q3). That’s as an aggressive development plan is winding up, including a pair of 1.1 gigawatt offshore wind facilities in Taiwan and Poland. So, the news was a surprise, dropping the stock by roughly one-third.

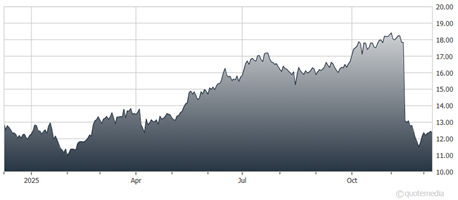

Northland Power Inc. (NPIFF)

It also overshadowed solid Q3 results, including 12.8% higher revenue, a 12.7% EBITDA increase, a 112.5% jump in free cash flow per share, and a 15.5% drop in debt interest costs.

Why cut the dividend now? Management cited an opportunity to accelerate investment with “accretive growth opportunities.” And it stated a desire to “maintain a strong balance sheet and preserve flexibility until the projects are complete.”

At this level, Northern’s dividend will be less than half free cash flow through 2030. That’s a huge cushion against unexpected offshore wind costs. Even at the reduced dividend rate, the stock still yields around 6%. It’s a buy for aggressive investors who don’t already have shares.