There are plenty of stocks still worth buying and holding out there…the same types of conservative, dividend-paying companies I’ve specialized in for more than 25 years. But there are far more groups to hate right now – one of which is the so-called digital asset treasury companies (DATCos), notes Nilus Mattive, editor of Safe Money Report.

Imagine a new publicly traded company called “We Love International Business Machines Corp. (IBM) Incorporated.” As its name suggests, the company raises capital by selling debt and equity and then investing the proceeds into shares of IBM.

Sounds stupid, right? After all, there’s no need for such a company because just about anyone can simply buy shares in IBM themselves anytime they feel like it. Yet, this is precisely the business model of digital asset treasury companies. The only difference is that they typically target a single cryptocurrency instead of a publicly traded company like IBM.

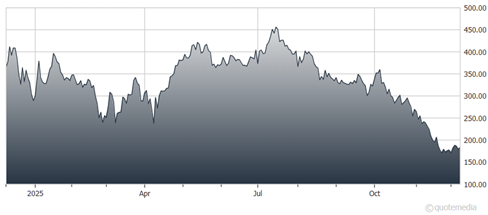

Strategy Inc. (MSTR)

Michael Saylor’s Strategy Inc. (MSTR) is the oldest and most famous example. For several decades, when it was still called MicroStrategy, the company actually made various software products that were unrelated to crypto. Then, around 2020, Saylor got bitten by the Bitcoin bug and decided to start stuffing the cryptocurrency into MicroStrategy’s corporate coffers.

Eventually, the entire company turned into one giant Bitcoin accumulation vehicle — the first DATCo. There was more logic to the idea back then. Bitcoin was still relatively hard to buy and sell, especially for larger institutional investors. And even individual investors were essentially locked out of the game if they wanted to use traditional brokerage accounts or IRAs.

But things have shifted markedly over the last several years. Most brokerage platforms have launched crypto arms. Plenty of ETFs covering Bitcoin and Ethereum are readily available. There are institutional-grade platforms available for buying and storing cryptos, too. And yet more and more DATCos have been showing up.

Between Jan. 2020 and Oct. 2025, the number of them went from four to 142…with roughly half created just this year alone. Many of these companies are simply trying to recast otherwise failing businesses. They’re relying on hype to generate valuations above and beyond their actual crypto holdings. And/or they’re serving as backdoor conduits for hedge funds and other players to offload positions onto less-sophisticated parties.

At a bare minimum, many DATCos are just inefficient “trust me, bro” investments actively trading a given crypto…often poorly. We also have to ask how much DATCo buying itself has actually supported crypto prices and fueled the recent rebound in crypto that has recently taken place. More to the point — is there enough real demand to keep the rally going?

Sure, it could all work out just fine. But I’m betting it won’t…at least in many cases.