I’m writing this aboard the 44th Forbes Cruise for Investors, where there is a high level of anxiety about a feared “AI bubble.” But I am doing my best to assure investors that unscrupulous short sellers are merely trying to ruin the market party, writes Louis Navellier, founder and chairman of Navellier & Associates.

In the end, these short sellers will be buried by strong revenues and earnings, and positive surprises and guidance...and 2026 is likely to deliver more of the same. With nearly all (97%, or 484) of the stocks in the S&P 500 Index (^SPX) having announced third-quarter results, revenues are up 8.2% (a 12-quarter high) and earnings are up 16.5% (a 16-quarter high).

(Editor’s Note: Louis will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

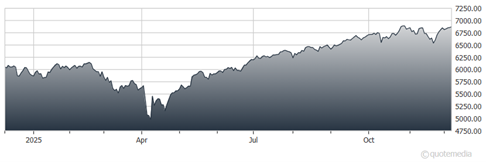

S&P 500 Index (^SPX)

The average earnings surprise was a whopping 9.6% (a 16-quarter high). Plus, 2026 revenues and earnings are now forecast to accelerate, with higher guidance, especially from data center companies with growing order backlogs.

I believe the US is in the midst of an exciting economic boom, which will expand in 2026. Clearly, all the onshoring of data centers, semiconductors, pharmaceutical, and automotive industries is creating an incredible economic growth outlook.

The US is also energy-independent and has many advantages over competing countries around the world, since overseas manufacturers can circumvent tariffs by onshoring. The year 2026 could go down in history as “economic nirvana,” with 5% growth and low inflation.