Enthusiasm for Bitcoin has faded in 2025 as price appreciation vanishes. After hitting a high of $123,900 on Oct. 7, Bitcoin slid into a sharp 32.2% drawdown and broke through the $100,000 support level. ETFs like the Calamos Bitcoin 80 Series Structured Alt Protection ETF – January (CBTJ) can help, says Tony Dong, lead ETF analyst at ETF Central.

Calamos Protected Bitcoin ETFs help investors stay exposed to Bitcoin while reducing deep drawdowns, offering defined protection levels (100%, 90%, 80%) and capped upside through quarterly vintages.

Calamos has long used derivatives-based strategies and hedging techniques across its options portfolios, and the firm applies that same expertise here. Each Protected Bitcoin ETF is issued in quarterly “vintages,” which begin every January, April, July, and October.

Timing matters with these ETFs, though not in the market-timing sense. The outcome period that defines each vintage’s gain and loss parameters is based on buying at the start and holding through the full term.

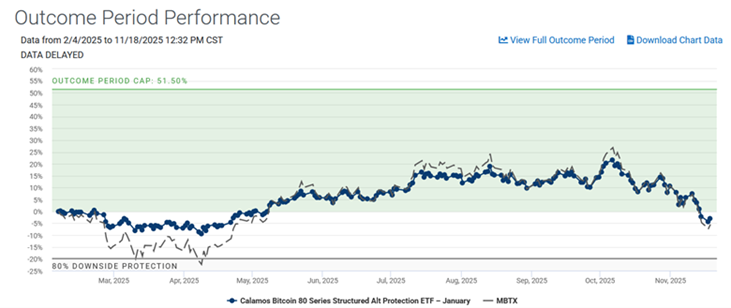

For example, CBTJ is designed to be purchased on the first trading day of January. Over the following year, the strategy limits the maximum loss to 20% before fees and expenses.

The Calamos Bitcoin 90 Series Structured Alt Protection ETF – January (CBXJ) follows the same structure with a tighter buffer, limiting losses to 10% before fees and expenses.

However, this protection comes with trade-offs. These ETFs use combinations of call and put options to build a collar that finances the downside buffer by capping the upside. As a general rule of thumb, more protection means a lower cap. For the most recent January vintage, CBTJ’s starting cap was 50.8%, while CBXJ’s was 29.3%.

The structure gives investors clear numbers to match with their risk tolerance. It’s often difficult to articulate what level of risk and reward feels acceptable. But defined loss limits and defined upside caps make the choice more concrete, especially for less-experienced investors.