Does Artificial Intelligence Capex present a threat to the AI story? The market has cited three main concerns regarding it: the sheer size, the use of leverage, and the so-called circular financing. But this is not the 1990s from a Capex standpoint, writes Nancy Tengler, CIO of Laffer Tengler Investments.

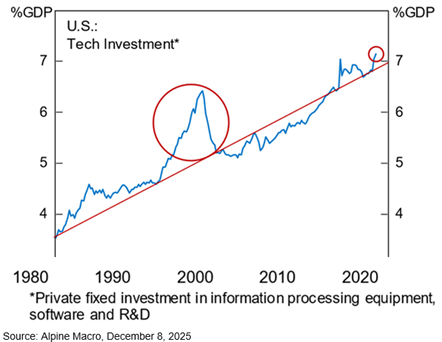

It is true tech spend is at a historical high. But it mostly reflects the structural rise in tech’s share of total investment. An economy in transition as my partner, Arthur Laffer, Jr. calls it.

The chart below shows that the current cycle spend is only slightly above trend. Compare that to the 1990s. Spend was way above trend then; it is not now.

(Editor’s Note: Nancy will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

Interestingly, while technology accounts for over 40% of the equity index, it only accounts for about 6% of the debt market. Debt levels are rising but not in the danger zone.