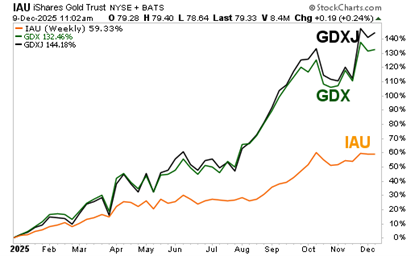

Let’s talk about central banks and gold. Central bank gold buying is picking up speed. That’s why you need to consider adding funds like the Van Eck Gold Miners ETF (GDX), up 132% so far this year, writes Sean Brodrick, editor at Weiss Ratings Daily.

Just in 2025 alone, we saw central banks, as a group, add …

- January: +17 metric tonnes

- February: +31 tonnes

- March: +34 tonnes

- April: +19 tonnes

- May: +20 tonnes

- June: +22 tonnes

- July: +10 tonnes

- August: +19 tonnes

- September: +39 tonnes

- October: +53 tonnes

As gold prices go higher, central bank purchases of the yellow metal are accelerating! Central banks were buying 20 tonnes when gold was at $2,700. Now they’re buying 55 tonnes at $4,000. I don’t blame them. They can print money for “free” and exchange that for the hard currency of gold. Heck, I’d do the same thing.

Will this continue? I firmly believe so. Central banks are buying hand over fist, with several analyses citing 2025 purchases running around 900-1,000 tonnes for the year. That strongly suggests even more buying in 2026.

In other words, the gold bull of 2025 may only be the warm-up act. The main event begins in 2026. The obvious ETF to play this is the SPDR Gold Shares (GLD). But you know what’s even nicer? The performance in gold miners!

Recommended Action: Buy GDX.