Autohome (ATHM)—a Chinese stock that came public in December 2013—earns a spot on my "buy and hold forever" list, assserts growth stock expert Timothy Lutts in Wall Street's Best Daily.

If you haven’t heard of it yet, you’re in the majority. But the company’s potential for growth is huge, which is why it makes the cut for this list of five stocks that could become huge winners.

Autohome’s business model is simple. It wants to be the center of all consumer-oriented automobile information in China. Today, the company’s business is centered on two websites.

But in the future, the sky’s the limit because the Chinese automobile market, though still rather young, is already bigger than the U.S. market and has much further to go.

Autohome began operations in 2004, and is still growing fast—revenues have grown at an average rate of 49% over the past four quarters. Earnings, though, have advanced more slowly (16%) as the firm invests in its infrastructure.

Autohome’s revenues come mainly from dealers (more than 20,000 use its services), which are steadily increasing the portion of their advertising and lead-generation budgets to the company’s services.

Mobile has obviously been a big focus, too — in the latest quarter, mobile traffic (to both the website and mobile apps) rose 23% from the prior year. Average time spent on the company’s mobile app by the average user was 18 minutes per day in the most recent quarter.

Also in the quarter, Autohome launched its Augmented Reality Showroom, which enhances user engagement and interaction.

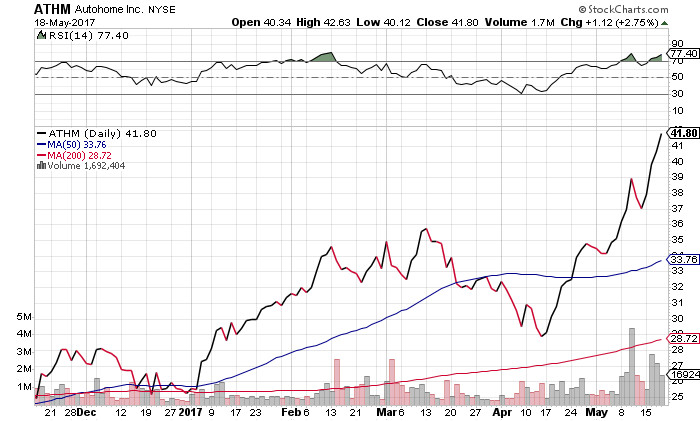

ATHM came public at 17 in late-2013, got off to a great start and was at 57 in the middle of 2015. But then the Chinese stock market fell apart (as did most emerging market stocks), eventually driving the stock down to 19 in late 2016—all despite steady increases in sales and earnings.

Since then, though, the buyers have begun to return, with shares tagging multi-month highs. And even last week, while most U.S. stocks were rolling over, ATHM kept climbing!

As a buy and hold “forever” stock, I’m more concerned with ATHM’s potential over the long haul. Long term, I’m very bullish on both the stock and the company, and I think that buying now will work out very well in the years (hopefully decades) to come.