I still find it curious that many investors don’t realize what a significant role royalty and streaming companies play in the mining business, notes Frank Holmes, CEO of US Global Investors, in Frank Talk.

I think that now is a good time to take another look at royalty companies. Here are the top six things I believe investors should know about this specialized sector.

1. What Is a Royalty Company?

Royalty companies, sometimes called streaming companies, serve a special role in the mining industry. Developing a mine property to start producing gold or other precious metal is an expensive, often time-consuming process. Infrastructure needs to be built out, permits applied for, laborers hired and more.

A royalty company serves as a specialized financier that helps fund exploration and production projects for cash-strapped mining companies. In return, it receives royalties on whatever the project produces, or rights to a “stream,” an agreed-upon amount of gold, silver or other precious metal.

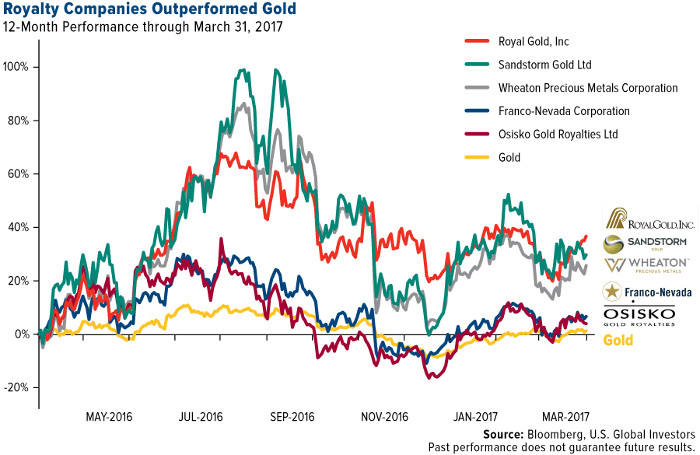

2. Many Gold Royalty Companies Have Still Been Outperforming Gold

When looking over the last 12 months, many of the royalty companies have outperformed gold. While this is indeed remarkable, it is important to remember that royalty companies do have a robust business model.

Their ability to generate revenue in times when the gold (or other precious metal) price is both rising and falling is what makes them attractive.

3. Remember Real Interest Rates

There’s no question that the gold price is volatile, and in any given 12-month rolling period, historically it’s not unusual for the price of the yellow metal to fluctuate up or down by 20 percent. It’s important for investors to remember that gold historically shares a strong inverse relationship with real interest rates.

This is another reason why I like the royalty model. Since royalty companies set fixed, lower-than-market prices for mining output, they can better manage the volatility that is inherent in the gold market.

For example, Wheaton Precious Metals (WPM) has made 19 agreements in 2016 which entitled the company to buy silver at an average price of $4.42 an ounce and gold at $391 an ounce.

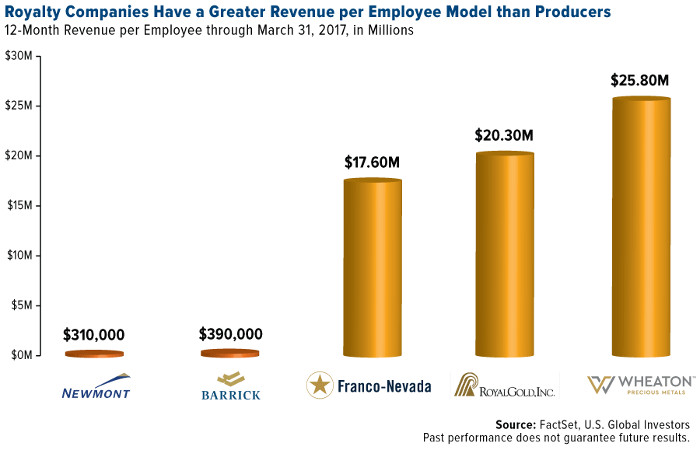

4. Speaking of Revenue

The three big royalty names boast impressive sales per employee. This is still true. Take a look at the 12-month revenue per employee of Franco-Nevada (FNV), Royal Gold (RGLD) and Wheaton Precious Metals.

Wheaton has only around 30 employees, but has one of the highest rates in the world, generating $25.8 million per employee. By comparison, Newmont Mining (NEM), which employs around 30,000 people, generated $310,000 per employee during the same period. Barrick Gold (ABX) also falls short by comparison.

5. Friendly to Shareholders

Paying dividends is important to investors, as it reflects the health of a company in terms of its cash flow and profits. Even more favorable in the eyes of investors is a company that is growing its dividends. Between 2012 and 2017, royalty companies had a combined annual dividend growth rate of 17 percent.

Compare that to 11 percent growth for the S&P 500 Index, and as low as negative 23 and negative 32 percent for global and North American precious metal miners. In fact, 2017 marks Franco-Nevada’s 10th straight year of dividend increases since the company went public in 2007.

6. Less Reliance on Debt

Royalty companies are better allocators of capital than some of the biggest gold miners. Take a look at Newmont Mining, which has a 43 percent debt-to-equity ratio, and Barrick has a massive 91 percent.

By comparison, many of the royalty companies have much lower debt, and Franco-Nevada has zero debt. This history of profitability and fiscal discipline is one of the main reasons I find royalty companies so attractive.