If this bull market continues for another 12 to 18 months, as I expect, US technology stocks probably will continue to outperform. But within tech, I think the big winners will be Internet and e-commerce stocks in emerging markets, asserts Michael Murphy, editor New World Investor.

China is moving rapidly into the 21st century. People in China don’t carry money anymore. They pay for everything with their phones.

All business and social meetings are set up with chats. They buy stuff online, watch sports and movies, do their banking, get doctor’s appointments and test results, book travel, play games with other people — all with their phones.

Other countries are watching. Installing a 4G cellular system is cheap, compared to putting in coaxial cable. Cell phones are cheap compared to computers.

Prime Minister Modi has put every Indian citizen’s fingerprints and retina scan in a data bank. All of a sudden, the 30% of Indians who never had birth certificates can open a bank account, buy and sell stuff, and participate fully in the online economy – with a cheap cellphone.

There’s an easy way for us to participate in this revolution, and capture some of the largest gains left as the bull market finishes its run. Buy the EMQQ Emerging Markets Internet & Ecommerce Exchange-Traded Fund

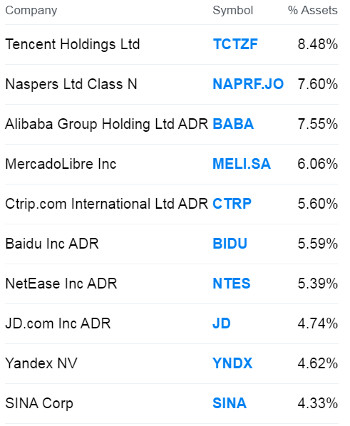

The Emerging Markets Internet & Ecommerce Exchange-Traded Fund (EMQQ) is a small, under-$100 million, little-known fund. In spite of its small size, its expense ratio is only 0.86%. Its turnover is a relatively low 31%, implying a 38-month average holding period. Its top 10 holdings are:

Tencent (TCEHY) and Naspers (NPSNY) account for 16% of the portfolio, and that’s a good thing. Tencent is going to be a huge winner. Tencent is the huge Chinese company that is the Facebook, eBay, PayPal and Wechat of China.

Naspers is a South African company that made a $34 million investment in Tencent that is now worth $88 billion.

They have other Internet, ecommerce, and video services, and recently merged their India online travel agency into MakeMyTrip (MMYT), India’s #1 online agency.

Alibaba (BABA) is the Amazon of China. MercadoLibre is the Amazon, Craigslist, Shopify and PayPal of South America. Ctrip is the biggest travel agency in China.

Baidu (BIDU) is the Google and YouTube of China. NetEase does video games in China. JD.com is the Best Buy and Craigslist of China. Yandex (YNDX) is the Google of Russia. Sina (SINA) is the Yahoo of China.

Obviously, EMQQ has a heavy emphasis on China right now because that’s where the most online stuff is happening. But they also have investments in other emerging markets and can follow the money as different areas come up to speed.

The ETF was up 39% in the first half of the year, but it’s stalled out for the last two months. That’s our opportunity. I think it can double from here before this bull market ends. Buy EMQQ up to $33 for a $66 target in 12 to 18 months.

Subscribe to Michael Murphy's New World Investor here…

http://newworldinvestor.com/