On a price to book metric (a long-term favorite here when looking for value in emerging markets, especially Asia), the energy sector trades at a 50 percent discount to its 20-year average, suggests Yiannis Mostrous, international investing expert and editor of Capitalist Times.

That makes it the cheapest sector in the emerging markets universe. Furthermore, the sector has lost more value than any other since the highs of 2007.

Asia, since 2000 really, remains the favorite region here in both the short- and long-term. The fundamentals of the Asian economies have constantly improved. And under the economic leadership of China and India, the region is poised to dominate for a long time.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

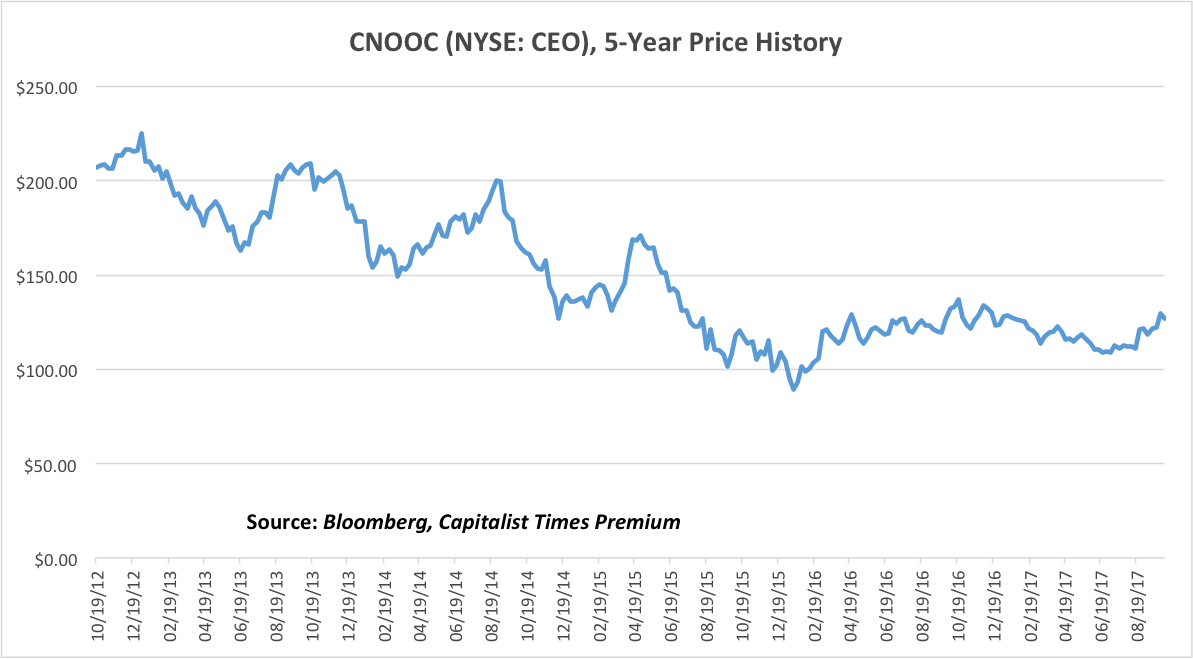

CNOOC (CEO) is the largest offshore oil and natural gas company in China focused on offshore upstream operations. CNOOC also has a significant presence in Canada, Nigeria, Australia, Argentina and Indonesia.

The company’s parent owns 64 percent of the shares and has a controlling share in oil services, refining, petrochemicals, fertilizer, engineering and LNG facilities.

CNOOC has a dominant position in natural gas, which represents 35 percent of its energy reserves and 17 percent of production. The company is one of three China national oil companies (NOCs).

For years, the company has been focused on growing reserves and production, as have all Chinese oil entities. Recently, though, management seems to understand that if CNOOC is to be viewed at par with its global peers, a focus on profitability and efficiency is needed.

Furthermore, company officers make clear that CNOOC will use all available tools (e.g., a clearer dividend policy) to maximize shareholder value.

For the first half of the year, the company successfully cut costs. These efforts are to continue, especially at current or higher oil prices. CNOOC is also well on pace to achieve its production target, even with potential disruptions due to hurricanes.

In the next three years, management expects that production will be between five and 10 percent higher than today. This estimate is based on the company’s strong domestic pipeline line new overseas projects. These new projects include partnerships in Brazil, Guyana and Nigeria.

Among the three main oil companies in China, CNOOC offers the biggest upside because of its strong balance sheet, free cash flow generation and global operations.

Its domestic position is expected to become even stronger as the company acquires offshore production sharing contracts from foreign operators that wish to sell.

Chevron Corp (CVX) and ConocoPhillips (COP) are two companies that might be interested in such a deal. With a 4 percent dividend yield, CNOOC is a buy up to $150.