Gold, silver, gold shares, and the resource sector remained under pressure this week. The contratrends remain underway and it looks like it has further to run, explains gold and resource sector expert Omar Ayales, editor of Gold Charts R Us.

Interest rates are dominating the markets. So far, the rise in the 10 year yield hasn’t helped the ailing dollar as it continued to decline to three year lows last month. The dollar has been forming a bottom and has started its rebound rise, but it’s slow going.

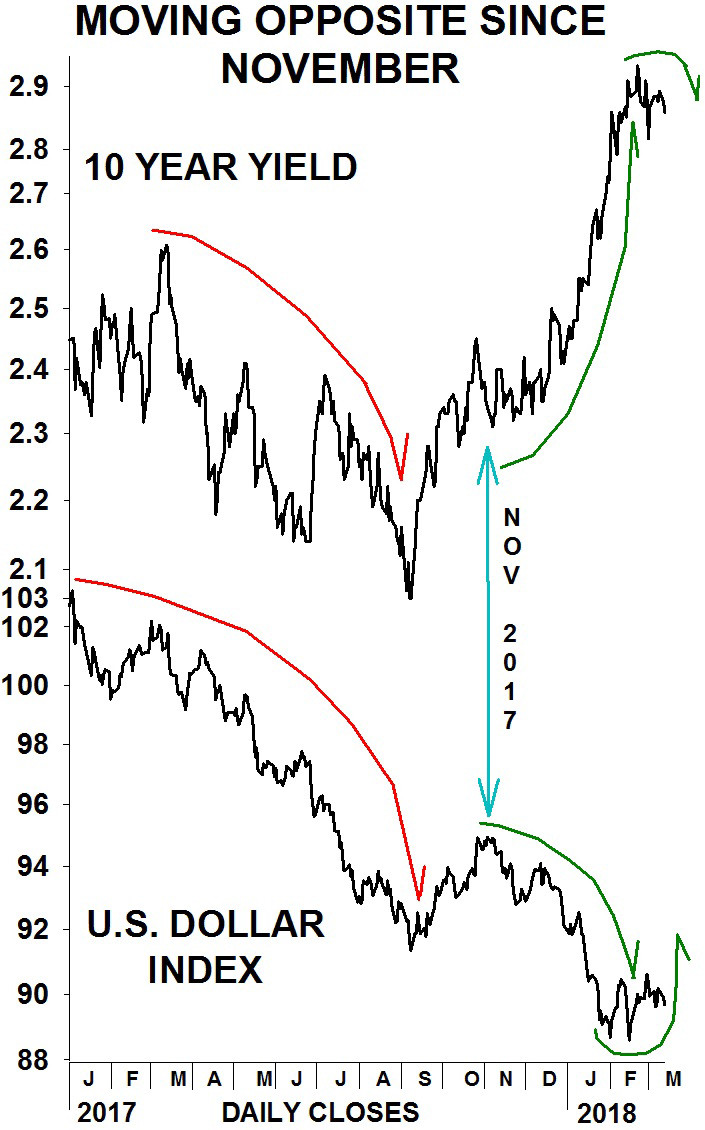

The chart below shows both the U.S. dollar and the 10 year yield. Notice in Nov. they parted ways. The dollar started to fall and rates started to rise as inflation and inflation expectations continue to grow.

Many are skeptical of the strength shown by the markets or even worse, we’re at the brink of a recession. And we could be. But you shouldn’t worry yet.

It’s not that this time it’s different, it’s that we haven’t really reached the levels of growth and velocity that precede economic recessions. Even though most of the past 10 years have been much about de-leveraging or re-financing taking advantage of historic low rates, real growth had remained tepid.

Keep in mind that during the past 10 years, easy monetary policies were geared towards keeping the economy afloat. The strength behind the stock market was earnings driven.

Today, accommodative fiscal policy is looking to boost real demand driven growth. Hence, the outlook for continued corporate earnings in certain sectors for the foreseeable future remains strong.

The tipping point in the bond market is indicative of rising inflation and inflation expectations. It’s not that higher interest rates are going to soak up investor demand and push stocks and commodities into a bear market. It’s that interest rates rise because there are less and less buyers of bonds.

Surely central bank purchases have accounted for a nice chunk of the entire bond market. However, consider the global bond market is valued at approximately 100 trillion dollars, more than double that of the global equities market. A correction or a bear market in bonds could see its value slashed in half or more.

Where will that money go? We’ve sustained real growth driven demand will continue boosting demand for all assets across the board, from stocks to commodities to currencies. We’ve seen it in the bull market cycles gold and copper started in 2015-16. Most impressive is that copper has been stronger than the S&P500 for the past year, and it still is!

And while owning gold shares has seemed like watching paint dry, patience will be rewarded. Mining shares still offer the best opportunities to profit given their depressed nature. But remember the old Wall Street adage, “the longer the base, the higher the space”.

Gold shares are coming from a year+ long sideways band, consolidating the explosive rise of the first quarter of 2016. They’re holding above key support levels and are positioned to rise.

We picked up more Agnico Eagle Mines (AEM) and Van Eck Vectors Junior Gold Miners (GDXJ) and have added to our positions. In addition, we’re also currently holding Wheaton Precious Metals (WPM) and Kirkland Lake (Toronto: KL).