One of the best investing maxims from legendary investor Sir John Templeton was to invest at the point of maximum pessimism — which describes the recent sentiment around gold, notes Tony Daltiorio, editor of Growth Stock Advisor.

Wall Street hates gold, and millennials are all buying cryptocurrencies. Adding insult to injury, Vanguard will rename the largest gold-oriented U.S. mutual fund and shift its focus to other commodity-related industries. That alone, from a contrarian viewpoint, tells me the bottom for gold is nearly here.

And there is more evidence, from a contrarian stance, that the peak in negative sentiment for gold is here. Hedge funds have just recently made one of their largest ever bearish wager on gold, raising their net short position in gold futures and options to the largest level since 2006.

Gold isn’t just a contrarian play. It actually does have some solid fundamentals supporting it. After rising every year since 2008 global gold supply plateaued last year, according to the World Gold Council (WGC). Global gold production rose to 3,268.7 metric tons in 2017 from 3,263 tons a year earlier, according to the WGC.

That was the smallest increase since 2008, when gold mined fell more than 2% in the midst of the financial crisis. In China, the world’s biggest producer, gold production fell by a record 9%. That was only the second time output has fallen in the country since 1980.

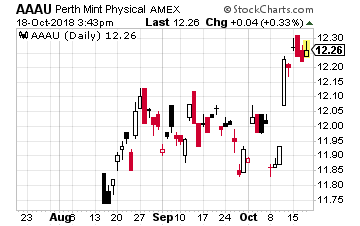

If you’re interested in owning gold, my favorite way to do so is through the Perth Mint Physical Gold ETF (AAAU). I own it and here’s why: the shares are backed by allocated gold secured within The Perth Mint’s network of central bank grade vaults in Western Australia.

;

;

All the gold held on behalf of AAAU is guaranteed by the Government of Western Australia. That’s because the Perth Mint is 100% owned by the Government of Western Australia and operates under an explicit government guarantee contained in the Gold Corporation Act of 1987. This covers the offerings and obligations of the Mint including the gold stored on behalf of investors in AAAU.

The Perth Mint is a favorite of people who want to own physical gold. It has been around since 1899 and it operates one of the largest refineries in the world. It is also one of the few firms globally that is fully accredited by the five major gold exchanges: London, New York, Shanghai, Tokyo and Dubai.

The beauty of this ETF though is that it allows AAAU shareholders to convert their shares directly into a wide range of gold bullion bars and coins from the Perth Mint at any time! It does this and still has a minuscule annual management fee of only 0.18%.