Enzo Biochem (ENZ) researches, develops, manufactures, and markets diagnostic and research products based on genetic engineering, biotechnology, and molecular biology, explains Bill Mathews, small cap specialist and editor of The Cheap Investor.

Its products are used by scientific experts in the fields of cancer, cardiovascular disease, neurological disorders, diabetes and obesity, endocrine disorders, infectious and autoimmune disease, hepatotoxicity, and renal injury.

It also operates a full-service clinical laboratory in Farmingdale, New York; a network of approximately 30 patient service centers in New York and New Jersey; and a free standing “STAT” or rapid response laboratory in New York City, as well as a full-service phlebotomy department.

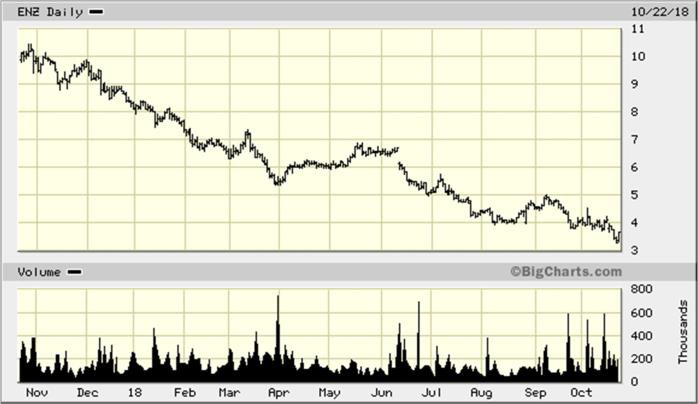

This NYSE-listed stock was selling for more than $12 just 14 months ago. Now that it has fallen 70%, we think it’s a good time to accumulate shares.

The company has a decent balance sheet with $60 million ($1.27 per share) in cash, a book value of $1.72 per share and a small debt of about $500,000. Insiders own about 7% of the 47 million shares outstanding, and 118 institutions own about 70% of the float (shares in public hands).

For the quarter ended June 30, 2018, the top ten institutional investors bought over 2 million more shares than they sold. Negative factors include the falling stock price, which is primarily due to lower revenues and higher losses.

Enzo Biochem is different from most development stage biotech stocks. It has healthy revenues, so it doesn’t need a large amount of cash. The company has several products in FDA trials and expects its cash to last for more than two years.

The number of outstanding shares is small in comparison to its revenue, and a large number of institutions own shares of the stock. If Enzo Biochem turns around its losses or releases good news about any of its products, the stock could really take off.