We think we are at the beginning of what's likely to be a long-term uptrend in stocks and we've found two perfect post mid-term election funds that offer upside potential and high yields, explains income specialist Michael Foster, editor of Contrarian Outlook.

Instead of getting the SPDR S&P 500 ETF (SPY), you could buy the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), a closed-end fund that owns the same stocks as SPY but pays a whopping 7.1% dividend, which is obviously a lot better than the 1.8% payout SPY gives you.

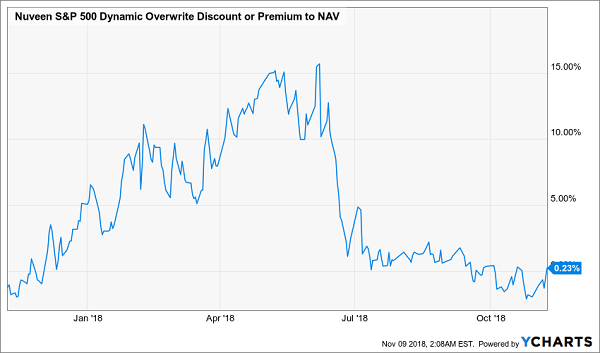

There’s another nice thing about SPXX: it’s not trading at a big premium for the first time in a while. Granted, it’s technically still at a small (0.2%) premium — but keep in mind that this is a CEF that’s often traded at a much bigger premium to its net asset value, or NAV (the real mark-to-market value of its portfolio) over the last couple years.

As a result, its current market price sits near levels we haven’t seen since the middle of 2017, in relation to its NAV:

Why has this premium all-but disappeared all of a sudden? It’s simple: with the market panic, the recent heavy investment in SPXX went with it—but that investment is about to come back.

The reason why? Volatility. You see, SPXX not only buys S&P 500 stocks, but it also sells call options (a type of derivative used by professionals as a kind of insurance on their portfolios), which are the main source of that 7.1% income stream.

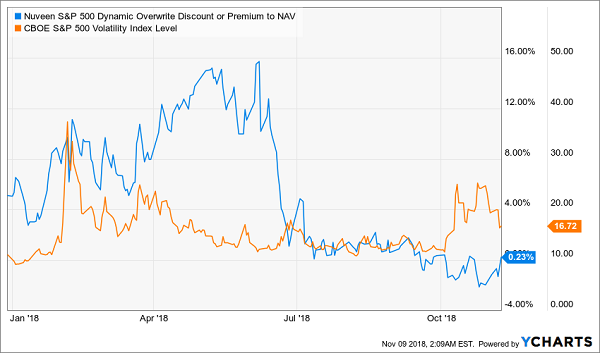

The income it gets from selling these options rises with volatility. Below, you can see the market jumping into SPXX, driving up its premium to NAV, when the VIX, a measure of how much volatility investors expect, rose at the start of 2018:

Notice how the fund’s premium has evaporated but volatility has recently spiked? That’s a market inefficiency—investors haven’t realized that this fund has an extremely safe income stream because of recent volatility, in addition to capital gains potential from its portfolio of stocks rising with the broader market.

SPXX isn’t the only fund you should consider now. There’s also the PIMCO Dynamic Income Fund (PDI), which has given investors a shocking return since inception—a whopping 188.2% in just 6 years!

Not only is that much bigger than the S&P 500’s still-impressive 125.3% return over the same time period, but PDI has also thrown off an 8.2% dividend yield that has been increasing in recent years. A high yielder that’s beating the market and growing payouts? What’s the catch?

I’ll be honest with you: the catch is fear. PDI doesn’t invest in stocks; it taps PIMCO’s crack team of analysts to invest in the most oversold mortgage-backed securities (MBS’s). If you saw The Big Short, you know that MBS’s were the derivatives behind the Great Recession.

Because of that, the much safer MBS’s that survive today have been undersold by a market suffering from recency bias—that is, the tendency for investors to think the next crisis will look like the last one, even though that’s never the case.

Because of a stronger economy, tougher banking regulations and much better lending standards, the MBS apocalypse of last decade is unlikely to happen again. But few investors are thinking rationally enough to pick up MBS’s, which has been an opportunity PIMCO has been exploiting for years — and PDI shareholders have been reaping the benefits.