I've learned to rely on the economists and money managers who have correctly predicted future market crashes; these experts are now screaming that the market is in deep trouble, cautions Jack Adamo, investing expert and editor of Insiders Plus.

The percentage of stocks above their 200-day moving average, just recently broke above the 2008 record bounce. A couple of other indicators, with similarly accurate predictive abilities in the past, have also broken boundaries that heretofore were unsurpassed, and were foolproof signs of an imminent market crash.

Despite these omens, we cannot be sure they still have their predictive ability. Such signals have become less and less reliable with regard to timing in this era of worldwide central bank interference with financial markets.

Adding to the Fed's flip-flopping its guidance every few weeks to allay investor fears and support stock prices, we now have Tweet-driven volatility that flips direction to the tune of the President's ever-changing remarks and intonations about the progress of trade talks, the uncertainty of which the market sees as the only reason the second-most expensive market in history should not continue to soar forever.

Meanwhile, back in the real world, adding to recent warnings about continuing declines in housing, auto sales, retail sales in general and the rise in consumer debt, the Citi Global Economic Surprise index, a traditionally reliable measure of the direction the economy is heading, is at -21.6.

That is nearly the same as it was at the December 24th market low, which was only exceeded by the Great Recession of 2008-2009. It has now been below zero for 227 days.

David Rosenberg, the Chief Economist & Strategist at Gluskin Sheff + Associates, characterized the markets as "totally devoid of economic realities," a view I've expressed for several months. Other top economists and smart money managers have done the same.

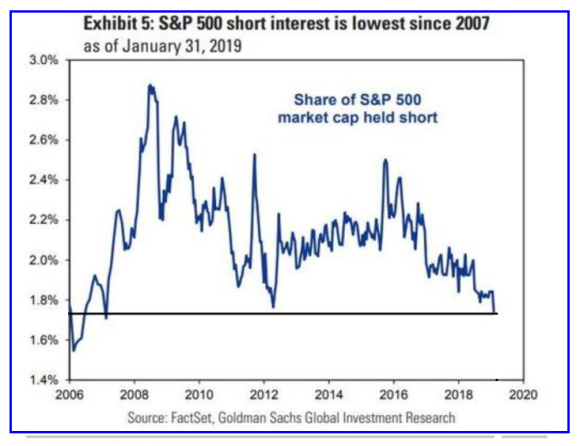

The chart below is from Goldman-Sachs. It shows that the share of S&P 500 market capital held short is now at the lowest level since 2007, just before the financial meltdown and "great recession" ensued and stocks plummeted.

Short-covering is the blowback from speculators short-selling stocks on margin. Massive corporate buybacks not only serve to drive up the value of executive stock options, but have a multiplier effect by forcing short-covering by large speculators.

Meanwhile, as we have seen for a long time, and particularly lately with Powell's marionette moves, Washington works for Wall Street. Moreover, lower interest rates help governments fund their huge interest payments, so the smart money goes with the supposition that interest rate hikes and balance sheet reduction will both be minimal.

Powell, although his heart was in the right place, is not strong enough to try to force fiscal responsibility onto the government's agenda. I don't fault him for that. I'm sure the powers that be would find a way to get rid of him if he continued on that course, and nobody likes looking for a job.

This environment keeps us in an uncomfortable position. The economy is not nearly as strong as Q4 GDP implies. In fact, it is showing signs of weakening in several important areas.

Nevertheless, the stock market continues to rise on hopes of a second half turnaround much touted by CEOs across many sectors, talking up the price of their stock (along with buying it back) so that their stock options are worth more.

I don't want to go into depth about how GDP is calculated or the fact that the way the U.S. does it is more aggressive than any of the other developed nations. I will just elucidate one fact: Increased spending by private or government entities raises GDP.

It does not matter whether that spending is paid for or is funded by debt. This is like saying you're doing better financially because you bought a new house, even though you borrowed from three difference credit cards to make your down-payment.

If you subtract the Q4 rise just in government debt, GDP growth was negative. We have seen new home and existing home sales fall for several months in a row with just one little blip up. December housing starts increased at the slowest pace since September 2016, when we almost went into recession (and the stock market showed it).

According to the New York Fed, auto loans that are 90 days or more past due surged in Q4 to the highest level since Q1 2012 and just 0.6% below the Great Recession peak in Q1 2011.

Growth in wholesale inventories adds to the GDP calculation. Inventories in Q4 increased by the most in five years, as sales fell for a third straight month. So, that boost to GDP is going to turn quite sour in the coming months, and may also contribute to inventory write-offs in upcoming earnings reports.

Also, maybe significantly or maybe not, seasonally adjusted weekly and non-seasonally adjusted year-over-year unemployment claims have risen the last couple of weeks. This trend hasn't been going on long enough to mean anything yet, but claims are a lagging indicator, so if it continues, it means the damage is more advanced than it seems, which would support other negative data.

China's stock market is now shooting up, giving the world hope that its second largest economy will boost growth worldwide, however, the boost is all done Western style, by flooding its economy with cheap money. So far, China imports are still way down. That doesn't contribute to world economic growth, so the jury is still out on how much the renminbi pump will help, if at all.

Okay, those are the salient points of why not to get into stocks now. The opposite side of this case is that the market doesn't care about any of that right now. It's looking down the Yellow Brick road to the Emerald City in the second half of the year.

So, what we have now is basically a war between speculators who see the handwriting on the wall for the economy and/or specific companies, and corporate execs with huge piles of cash either borrowed, or extracted from shareholders' banked earnings. The execs also have the financial media on their side, who act as carnival barkers for the companies' tent shows.

The question for us now is how long will the corporate war chests hold out and will this aggression be rewarded and supported by inflows from the public.

The answer to that is unknowable or at least far beyond my abilities. I don't feel badly about that. All the smart money I follow is equally without certainty or even good guesses. So, for now, we will continue to tread water until we can feel which way the current flows.