The Real Estate Select Sector SPDR Fund (XLRE) is an exchange-traded fund that can give a prospective investor access to the segment of the global economy that is involved with real estate, notes ETF expert Jim Woods, contributing editor to StockInvestor.

Specifically, XLRE tracks the Real Estate Select Sector Index, which, in turn, attempts to provide an effective representation of the real estate sector of the S&P 500 Index.

This exchange-traded fund was launched in October 2015 when the Global Industry Classification Standard (GICS) financial sector was divided into the financial sector and the real estate sector. Initially, its liquidity was quite poor as it was unable to match the level of liquidity that its sister ETFs had managed to obtain.

However, this situation changed in September 2016, when XLRE’s sister ETF — the Financial Select Sector SPDR Fund (XLF) — had to part with its real estate investment trusts (REITs) to meet the new classification standard.

As a result, Financial Select Sector SPDR Fund transferred $3 billion in assets under management to XLRE. By doing so, XLRE’s liquidity improved a great deal. Currently, the fund’s assets are divided among specialized REITs: 43.60%; Commercial REITs, 39.50%; Residential REITs, 14.70%; and Real Estate Services, 2.20%.

This fund’s top holdings include American Tower (AMT), Crown Castle International Corp. (CCI), Prologis Inc. (PLD), Simon Property Group (SPG), Equinix Inc. (EQIX), Public Storage (PSA), Welltower (WELL), Equity Residential (NEQR) and AvalonBay Communities (AVB).

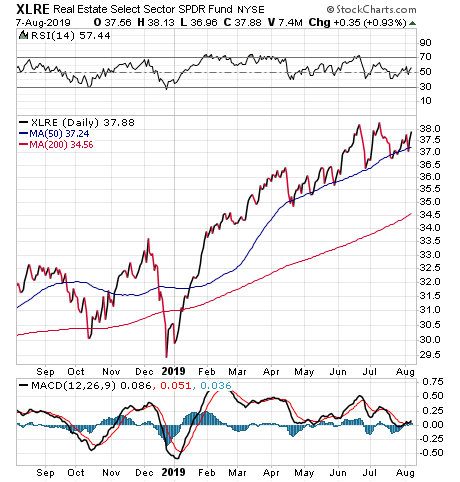

The fund currently has more than $3.57 billion in assets under management and an average spread of 0.03%. It also has an expense ratio of 0.13%, meaning that it is less expensive to hold than many other ETFs. This fund’s performance has been solid in both the short and long terms.

While XLRE does provide an investor with a chance to profit from the real estate segment, the sector may not be appropriate for all portfolios. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.