Our research team believes the Coronavirus outbreak will cripple economic expansion and consumer economic activity in China and much of SE Asia over the next few weeks and months, cautions Chris Vermeulen, chief market strategist at The Technical Traders.

If the virus spreads into India, it could quickly target large portions of India’s economic capabilities. We are very early into this potential pandemic event.

Skilled traders must understand that the world is far more inter-connected economically and via transportation than it was even 50 years ago. More people travel to various parts of the world more often than ever before. More goods and services travel back and forth across oceans and continents than ever before.

This inter-connected world is actually quite small when you consider a student or vacationer can travel more than halfway around the planet in less than 35 hours, access two or three major transportation hubs and have direct contact to dozens of people and indirect contract to thousands of people within that span of time.

Our concern is, quite literally, that the growth of the number of infected people related to this Coronavirus is only just starting to explode. Our research team believes the next 6 to 12 months will become very telling regarding the real economic contraction resulting from the Coronavirus spread.

We believe the initial measures governments and world organizations are taking will shrink economic opportunity by at least 10% to 20% for certain nations.

If the virus explodes into Africa, or the Middle East, or North America, then we have another set of problems to deal with. At that point, the economic ramifications could result in a 30% to 50% contraction in certain segments of the US and Gglobal economy.

Let us try to explain our thinking…

No, people will not stop buying toilet paper, toothpaste, food, and other essential supplies, but they will likely slow their purchases at Starbucks, movie theaters, social events, traveling to unknown areas and shopping in large exposed areas (big box stores). Anything that is perceived as a risk will be viewed as potentially dangerous and unwanted.

Consumers and businesses are like flocks of birds or schools of fish, they all seem to turn to follow the others and move as a single group or “beast”. If consumers start to pull back as this issue extends, we expect the “beast” will follow this trend until the risk is minimized.

US economic numbers from Q4 are still landing with very strong numbers — but remember this data does not include any real data from the current quarter. Everything looks really good if you ignore the threat of the Coronavirus going forward (which is rather foolish).

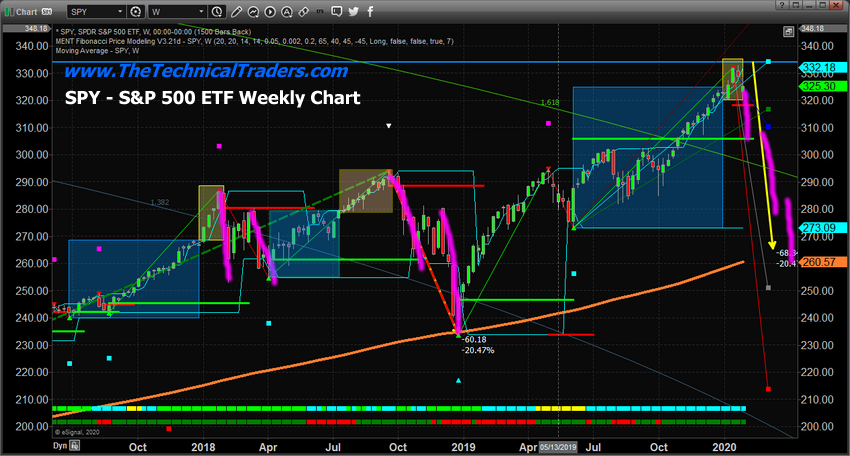

Q1 and Q2 2020 could become a completely different set of numbers. We believe a waterfall decline is still a very valid interpretation of the global market future reaction throughout most of Q1 and Q2 of this year.

Downside price rotations will come in waves or waterfall events and could target various sectors of the US and global markets. We don’t see any real alternative other than price contraction as long as the Coronavirus continues to wreak havoc across the planet.

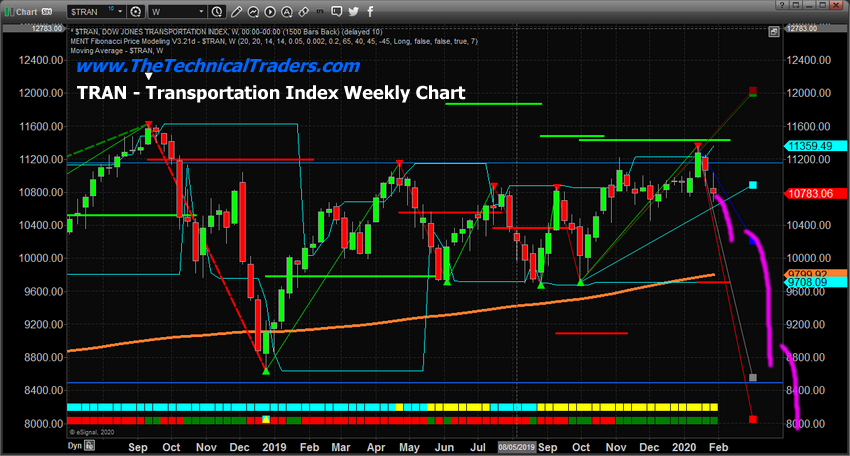

Pay attention to what the Transportation Index is doing as this outbreak continues. Slowing consumer activity means essential items will still be in high demand, but big-ticket items, cars, luxury, and vacations may see a dramatic slowing in sales and activity. Even homes and apartments may slow in sales. People tend to become very protective and secure in these economic modes.

The Transportation Index may initially fall to levels near 10,200 before finding any real support. Then a further downside move may target longer-term support near 8,500. Below that level … well, let’s just say that below that level and we could be well into a very serious Bearish contraction phase of the global markets.

If the virus is suddenly contained and diminishing, or cured, then we believe the global perception will change back to positive very quickly. However, investors should take this time to reposition assets and protect value. You can always redeploy your capital when you feel the time is right to jump back into the markets.

We believe the next 60 to 90 days will become very informative relating to the spread and capabilities of this virus and our ability to fight it. Don’t let this volatility be something like 2009 when you look back and say, “I should have known better”.