Human emotions — namely fear and greed — have always played an important short-term role in moving the stock market, asserts Tony Sagami, editor of Weiss Ratings' Daily Briefing.

Fear has been on full display over coronavirus fears. Anyone who peeked at their 401k balance lately may feel a little light-headed.

And figuring out how much you’ll need to put away for retirement is already a struggle. It’s much more important than the day-to-day gyrations of the stock market. However, if you ask a dozen financial planners the best way to save, you’ll get a dozen different answers.

That’s because, in truth, the answer is different for everyone. But the best place to start is to estimate how much income you’ll need to support the retirement lifestyle you want to live.

Now, while this will vary widely from person to person, the average 65-plus-year-old American spends an average of $46,000 a year, according to the Bureau of Labor Statistics.

And with the average life expectancy in the U.S. hovering around 79 years — slightly more for women and slightly less for men — you should plan for (at least) 14 years of retirement. A little math for you: 14 years X $46,000 a year = $644,000.

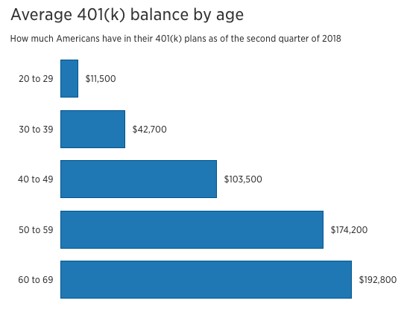

So how much do you have stashed away in your 401k? For most Americans, the answer is woefully inadequate. The Center for Retirement Research estimates that 42%-to-60% of Americans have not saved enough money to finance a comfortable retirement.

In short, you need to save for more. Good news — 401(k) contribution limits increased in 2020 from $19,000 to $19,500 for workers under 50 years of age. And if you’re over 50, you can sock away as much as $26,000.

Do yourself a favor and find a way to hit those new maximums with your 401k. And if you simply can’t hit the $19,500 or $26,000 maximums, at least force yourself to sock away more this year than you did the year before.

And don’t forget the importance of making your savings work as hard as you do, which brings me back to the market’s recent shellacking."

If you’re thinking about selling ... don’t. This is a common reaction to market volatility. Investors get scared out of the market entirely. Or, traders will sell positions that are doing well to offset losses on those plummeting. But either reaction leaves you out in the cold when the markets pick back up. Instead, consider a low-volatility alternative.

There are a handful of ETFs that have reached the sweet spot of what academics call the “efficient frontier.” This is the point where investors get the maximum amount of gain for the least amount of risk. For example, the Invesco S&P 500 Low Volatility ETF (SPLV) is one such all-weather all-star.

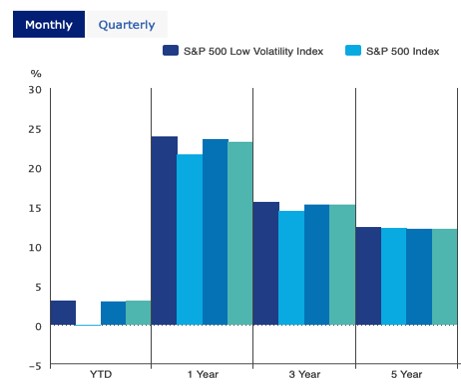

It sounds counterintuitive, but the low-volatility stocks have actually outperformed high growth, turbocharged stocks. In fact, SPLV outperformed the S&P 500:

- By 24% last year

- By an average of 15.6% per year over the past three years

- By an average of 12.5% per year over the past five years

SPLV has a beta of 0.58 over the last five years, which means it has 42% lower volatility than the overall market, and a standard deviation of 8.9% versus 11.4% for the S&P 500.

This outperformance hasn’t come at the expense of higher risk. The opposite is actually true: SPLV invests in the 100 stocks of the S&P 500 that have had the lowest amount of volatility over the last 12 months.

So, what qualifies as a low-volatility stock? Traditional, conservative, even boring sectors: Utilities (29% of the portfolio), real estate (21%) and financial (16%) stocks.

When times are good, any ole’ stock will do, which is why some of the best-performing stocks have been the ones with the weakest balance sheets but the most promise. If the stock market starts to struggle, boring will be beautiful.

That doesn’t mean you should rush out and buy SPLV tomorrow. As always, timing is everything. But it is an excellent example of how to manage risk instead of fleeing from it. Something you should keep in mind as headlines and the market raise red flags of volatility.