There has been a shakeout in the leveraged loan market (floating rate loans that are below investment grade). We invest client assets in this type of debt using floating rate loan funds, suggests Marvin Appel, editor of Signalert Asset Management's Systems & Forecasts.

From Feb. 21 – March 24, floating rate bond funds lost about 20%, their worst decline since 2008. However, they have since recovered some of those losses. We believe it is a good time to re-enter this area cautiously.

Back in 2019 floating rate loan funds became less attractive to us for two reasons. First, with the Federal Reserve reducing rates, their yields fell.

Leveraged loan coupon yields reset quarterly in parallel with the Fed Funds Rate and tend to match the prime rate but with a floor of 4%. (The prime rate is now 3.25%, so the Fed would have to raise the Fed Funds Rate by more than ¾% before interest payments from leveraged loans start to increase.)

Second, over the past five years the overwhelming majority of floating rate loans were originated “covenant light”, lacking the usual lender protections that banks used to demand of borrowers before the hunger for yield gave borrowers the upper hand. Despite these drawbacks, floating rate loans were priced for perfection along with many other risky assets.

As a result of the significant potential downside and limited potential upside, we moved client assets out of floating rate funds and into short-term corporate high yield bond funds in the middle of 2019 (before moving our clients out of corporate high yield bond funds on Feb. 27).

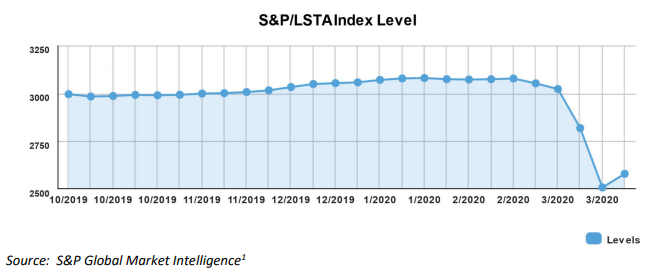

Losses in March have rectified the leveraged loan market’s earlier excesses. According to S&P, the average price for leveraged loans is 85 cents on the dollar (80.5 cents bid), down from near par in mid-February. (See chart above which shows the sharp price decline in February-March.) According to S&P the average clearing yield for leveraged loans is now 6.2%.

Even if 20% of leveraged loans default (a level of defaults that would exceed the peak of high yield defaults reached at the nadirs in 2002 and 2008), diversified investors could come out whole: 20% of the portfolio would lose 80 cents on the dollar (actually less than that since there is some recovery in the event of a default) while the remaining loans would eventually be paid off at 100 cents on the dollar.

If defaults don’t reach 20% or if recoveries from defaulted loans are significantly above zero, then floating rate loan funds should be profitable due to the interest received and the purchase of debt well below par. (The worst high yield recovery was about 20 cents on the dollar in 2008-2009. Floating rate loans are typically senior to high yield bonds and so should have even better recoveries.)

The newsletter high income portfolio took a position in Credit Suisse Floating Rate Fund (CHIAX) in late March. If you choose to add to positions in floating rate funds, use a trailing 3% sell stop (based on total return to account for accumulating interest income).