We know that the best results come from being invested long term, but how can you stay invested when there’s always some cause for concern? asks Janet Brown, editor of NoLoad FundX.

We talked with a subscriber recently who’s worried that the stock market is too high and due for a pullback so he’s thinking about selling some of his stock funds. We cautioned that changing his portfolio based on a premonition about future markets may put his plans at risk.

What to do instead? The first step is to make sure you have an appropriate allocation to stock and bond funds, and that you have a rules-based strategy that can help you avoid making emotional investment decisions. Your behavior is another crucial part of the equation, though.

If you panic, there’s not much your allocation or your strategy can do about it. So a key part of staying invested long term is learning how to manage your short-term fears.

In our nearly 50 years of managing money for clients, we’ve found that there are four habits that can help you quell your fears of what might happen in the market in order to reap the rewards of long-term investing. Here are four habits of long-term investors:

1. Don’t get distracted by headlines

You expect the news to help you make sense of the world, but the news disproportionately focuses on market declines, which can stoke your fears and distract you from your long-term goals.

What matters in the market isn’t usually what you’re hearing on the news. Market historian Jeremy Siegel found that less than one-quarter of major market movements were associated with big political or economic news.

Markets typically react differently than most news pundits expect. In the early 1990s, investors thought the market would fall if then-President George H.W. Bush went to war with Iraq, but markets actually soared when the U.S. took action in Kuwait.

More recently, many anticipated that a vote for Brexit or for Trump would destabilize markets around the world, but global markets took the news in stride.

2. Set realistic expectations

It’s easier to keep a long-term focus when you know what to expect, and you should expect to face both up and down markets.

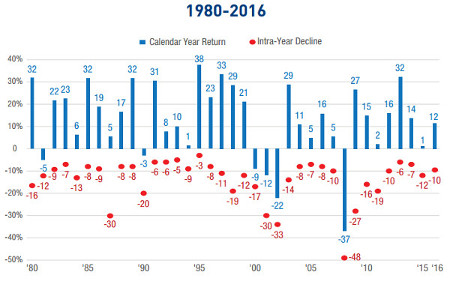

Many investors think that market declines are a problem that they need to solve, but long-term investors understand that market corrections are normal and happen every year, as the chart below shows. On average, the market has suffered an intra-year decline of about -14%.

As you can see, gains are also normal, and historically you’ve been rewarded for staying invested. Even though stocks pulled back at some point every year, they had positive calendar-year returns in 28 of the last 37 calendar years (75% of the time).

S&P Calendar Year Returns & Intra-Year Declines:

3. Make a plan

Since markets decline every year, it makes sense to have a plan that can help you stay on track during these sell-offs. Don’t wait for a sell-off to decide what to do since you probably won’t make your best decisions when you’re fearful.

Instead, take some time now to think through what you can do to avoid selling in a panic and putting your retirement at risk.

Your plan might include reaching out to an advisor and talking through your concerns. If dire news reports distract you, your plan might include avoiding the news for a spell, and if seeing losses in your accounts makes you panic, you might stop opening your statements during a sell-off.

If you have a history of selling entirely out of the market, then work on making small changes that can help you avoid extreme moves.

You might plan to sell 10% of your stocks to avoid selling 100% later, or you could use declines as an opportunity to rebalance your allocation to stock and bond funds. Whatever you decide to do, write it down so you can refer to it later.

4. Focus on what you know

Uncertainty is part of investing, just like it’s part of life, but you can work through it by focusing on what you know. You know why you’re investing, and that your goals remain the same, no matter what’s happening in the market.

You also know that even if you happen to invest at the very worst times, like the peak of the market in October 2007 right before the severe 2008-2009 bear market, you still would have come out ahead as long as you stayed invested.

History has shown that short-term events have little long-term impact on the value of stocks. Stocks have been positive over every rolling 20 calendar-year period since 1950 and a portfolio of stocks and bonds has had positive returns in every rolling five-year period. If you can stay invested, those gains can change your life.