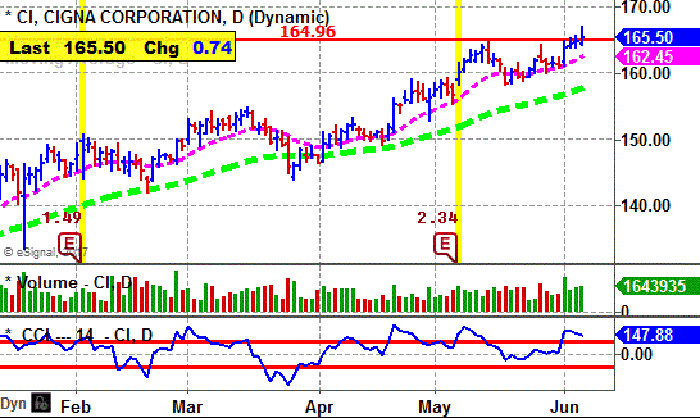

Cigna (CI) — which provides medical, dental, disability, life and accident insurance — has broken out from a five-week flat base; the stock is within range to challenge its all-time high of $170.68 set back in 2015, asserts breakout specialist Leo Fasciocco, editor Ticker Tape Digest.

Technically, CI's long-term chart shows the stock falling to a low of $9.82 in 2008 due to the bear market. The then worked steadily higher over the years to reach an all-time high of $170.68 in 2015.

It pulled back to base, but has since come on strong. The stock's 12-month performance chart shows the stock appreciating 28% versus a 15% gain for the stock market.

CI's long-term chart shows the stock falling to a low of $9.82 in 2008 due to the bear market. The then worked steadily higher over the years to reach an all-time high of $170.68 in 2015.

It pulled back to base, but has since come on strong, with the stock advancing steadily to a peak near $164. The stock has put down a small cup-and-handle base. The recent breakout clears upside resistance and the stock's momentum indicator remains solidly bullish.

This year, analysts are forecasting a 20% increase in CI's net to $9.70 a share from $8.10 a year ago. The stock sells with a price-earnings ratio of 17. We see that as reasonable.

Net for the next two quarters will be strong. Net for the second quarter should be up 24% to $2.45 a share from the $1.98 the year before.

The highest estimate on the Street is at $2.50 a share. Net for the third quarter is expected to climb 22% to $2.37 a share from the $1.94 the year before.

The company topped the Street consensus estimate the past three quarters. Going out to 2018, they look for a 15% rise in net to $11.18 a share from the anticipated $9.70 this year.

Insiders have been recent buyers using stock options at $58 to $78 a share. They were sellers at $152 to $161 a share. We are targeting the stock for a move to $190 off this breakout. A protective stop can be placed near $158.