One factor that I believe is propping up equities is ultra-low interest rates, combined with massively high bond prices (remember that bond prices and yields move inversely). explains Matt Kerkhoff, money manager and editor of Sigma Point Capital's Market Analysis.

Low interest rates (and correspondingly high bond prices) push investors into stocks, and make even a paltry 2% dividend yield on the S&P look enticing.

All else equal, low interest rates also mean that future profits are worth more in today’s dollars, which increases the valuation levels at which stocks should trade.

In other words, there is, once again, no alternative to stocks if you want your purchasing power to grow (and aren’t willing to buy bonds in the hope of selling them to someone else at even higher prices).

Finally, the third reason why I think stocks remain elevated is because a) the tariff pain is largely self-inflicted and we could see some type of resolution, and b) Mr. Powell and the Fed clearly have the market’s back.

While I’m not convinced that business spending will rebound quickly after an end to the trade war (major disruption has occurred to very complex supply chains that had previously been in place for decades), I do think we’ll see the market rally. This is simply due to the removal of an immense amount of uncertainty.

In addition, I have learned over many years that fighting the Fed is mostly a losing proposition. Whether rate cuts will have their intended stimulative effect on the real economy is up for debate, but they do have a strong record of pushing equity markets higher.

In recent remarks, Mr. Powell has said he will do whatever’s necessary to keep the economy expanding, and that means taking us ever closer to the zero bound.

One final factor worth keeping in the back of your mind is this: 2020 is an election year, and since World War II, no incumbent president has ever lost re-election in a growing economy.

If you need that statement translated, it means Trump will likely do everything in his power to keep the economy growing through the end of 2020.

Whether that means finding a way to end the trade war, pummeling the Federal Reserve into more rate cuts, or passing more spending bills, Trump is not likely to hold any punches when it comes to staving off a recession.

Therefore, both the President, and the Chairman of the Federal Reserve – arguably the two most influential decision makers in the world — are auguring for higher stock prices.

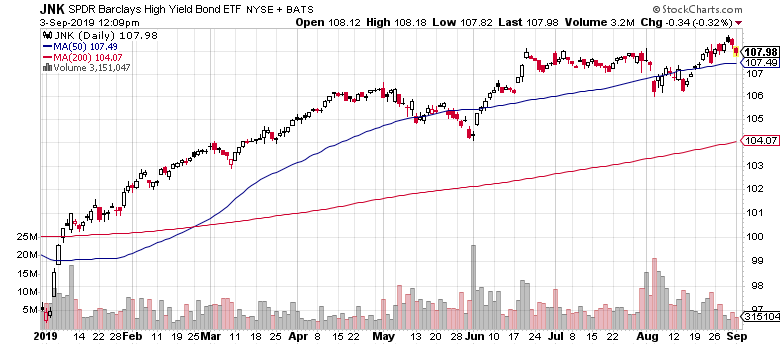

Let’s wrap things up with a chart of the Barclays High Yield Bond ETF (JNK):

This ETF remains just off its highs, and in my opinion is one of the most important items you can be watching right now. Eventually, we’ll see a stock market selloff that includes a major move away from junk bonds.

I believe that will be one of the earliest and most accurate clues that the corresponding selloff in stocks is indicative of a major downturn, and not just a run-of-the-mill correction.

Thankfully, junk bonds remain in high demand, so I believe maintaining your core positions in equities remains appropriate for now.