I’m going to show you my favorite (perfectly legal) way to pay zero tax on your dividend income. To understand the big savings this could mean, let’s look at two fictional investors who are nearing retirement: Jane and Janet, notes Michael Foster, editor of Contrarian Income Report.

We’ll assume both are single, earn $50,000 per year and live in a state with no income taxes. Now let’s assume Janet has taken the so-called “right” path, as suggested by her financial advisor, while Jane has steered her own course. A quick look at both will show how that “right” path can create a hefty tax problem.

Let’s say Janet put a million dollars in the Vanguard S&P 500 ETF (VOO) because she’s been told that a low-cost index fund is best for retirement.

VOO is giving her $14,100 in annual dividends as a result, but because Janet is still working, she’ll have to give Uncle Sam $1,864 in taxes on her dividends for just one year — and that doesn’t include tax she’ll pay when she eventually sells her shares.

Over to Jane. Instead of following the herd and buying VOO, she’s put her million in a lesser-known fund called the Nuveen Municipal High Income Opportunity Fund (NMZ), which pays a 5% dividend yield, giving her an income stream of $50,000 from her investment. Not only is her nest egg now entirelyreplacing her work income, but she’s also getting allof it.

That’s right. Of that $50,000 a year NMZ is giving Jane, zerois going to Uncle Sam. And it doesn’t matter if she gets a promotion at work and makes more, or if NMZ starts paying her more. She will not have to pay anyof her income from this fund to the tax man.

Of course, the more Janet gets paid, the more taxes she’ll have to pay out. If her work pay rises 20%, for instance, the tax on her dividends will climb to $2,115 per year, meaning her tax burden has gone up by almost as much as her raise!

While many muni bonds are gobbled up by wealthy investors looking to cut out the tax man, the middle class often ignores them. One reason why is fear: headlines about municipalities going bankrupt and leaving investors in the cold result in paranoia—and many bad investment decisions.

Here are the facts: according to Moody’s, the total default rate of muni bonds since 1970 is 0.09%. And with $1.5 billion in assets, NMZ can diversify across many bonds (it currently holds 598 of them) to slash the risk of being exposed to a default.

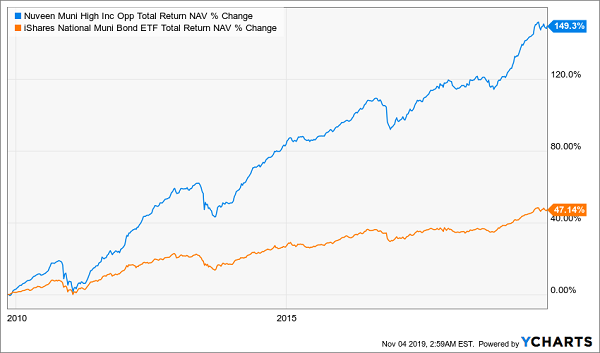

This doesn’t just make NMZ safer, it’s also made the fund’s returns impressive. Thanks to NMZ’s unique market access and expertise, it’s crushed a muni-bond index fund like the iShares National Muni Bond ETF (MUB), in orange below. It’s rare to get superior returns and greater safety, but NMZ delivers both.

There’s one last reason why Jane would be smart to buy NMZ: the Federal Reserve. In 2019, the Fed cut interest rates three times, which has had two effects on muni bonds. The first is that they’re more attractive to investors than before.

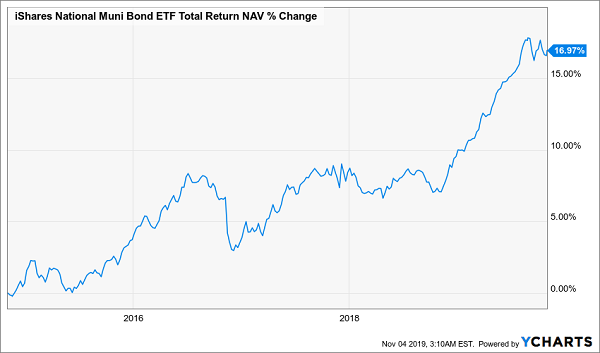

From 2015 to the start of 2019, when the Fed was raising interest rates, muni bonds were struggling to make headway, as you can see in the chart below:

There are two reasons why munis stalled in this period: first, many investors thought they could get higher income streams elsewhere as rates rose. Second, and more important, bonds fall in value as interest rates go up, which meant the resale value of these bonds dropped with the Fed’s aggressive rate-hike cycle.

Fortunately, the opposite is also true: lower rates mean muni bonds go up, which is why you see that huge hockey stick at the end of the chart above.

It’s also why NMZ raised its dividend earlier in 2019, and why it may raise it again. The Fed’s aggressive rate cuts have been a blessing for munis this year, and with the central bank likely to continue lowering rates, that hockey stick will get bigger.