Stocks were lower this morning after closing mixed yesterday (The Nasdaq had a strong day, while the Dow underperformed). Gold and silver were...you guessed it...mixed as well in the early going, while crude oil was down. The dollar and Treasuries were higher.

On the news front...

Not to be outdone by the US Federal Reserve, the Bank of England said “Me Too”...and hiked interest rates by 25 basis points to 4.5%. That was the 12th rate hike in a row in the UK, and it leaves the benchmark rate there at its highest level since October 2008. The BOE’s post-meeting language left the door more widely open to additional hikes than the language used by the US Fed recently.

Shares of The Walt Disney Co. (DIS) dropped in the early going after the entertainment and theme park giant missed quarterly earnings estimates. The park business performed well, with operating income of $2.17 billion. But just like other streaming operations, Disney+ is bleeding red ink. It lost $659 million, though that was down from $1.1 billion a quarter earlier.

Stop me if you’ve heard this before but...a regional bank is tumbling again in the early going. PacWest Bancorp (PACW) is the one this time, plunging 20% in the early going after saying deposits dropped by 9.5% in just a few recent days. That said, management said the bank has $15 billion in liquidity accessible and enough cash and cash equivalents on hand to meet its needs for the next year.

Finally, China is racing to adapt to a world where it’s cut off from access to Western chip-making equipment and know-how. The country’s semiconductor manufacturers are attempting to use state funding, access to older equipment, and gear produced within China to circumvent the sanctions and keep its companies afloat, according to the Wall Street Journal.

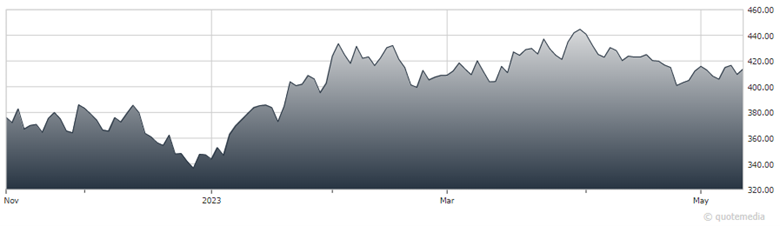

iShares Semiconductor ETF (SOXX)

As an aside, the iShares Semiconductor ETF (SOXX) has been a stellar performer in 2023, up 19% year-to-date. Its largest holdings include NVIDIA (NVDA), Broadcom (BRCM), Texas Instruments (TXN), and Advanced Micro Devices (AMD).