Stocks enjoyed a nice ramp yesterday, but they’re subdued in the early going today. Gold and silver are off just a smidge along with crude oil. Treasuries and the dollar are higher.

On the news front…

Recession? WHAT recession?

That’s what investors were left wondering after a rash of strong economic reports in the last 24 hours. New home sales surged 12.2% in May, far above Wall Street’s expectations. A key indicator of business investment found in the durable goods data jumped 3.4%, an increase the size of which we haven’t seen since 2020. Consumer confidence also rose to its highest level in 18 months.

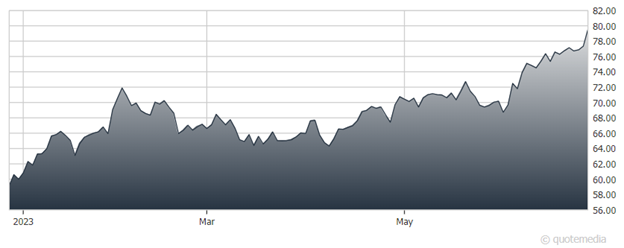

The news helped fuel big gains yesterday in economically sensitive sectors like transports and housing. In fact, the iShares Transportation Average ETF (IYT) is now up more than 18% this year. The SPDR S&P Homebuilders ETF (XHB) has surged 36% -- an impressive feat given how far mortgage rates have risen in the last year and a half.

SPDR Homebuilders ETF (XHB)

The Russian “coup/mutiny/whatever we’re going to call it” story keeps getting curiouser and curioser. The latest? The New York Times is reporting that Russia’s former top commander in Ukraine, General Sergei Surovikin, worked with Wagner Group head Yevgeny Prigozhin to help make the coup attempt possible. Questions are now swirling about who in President Vladimir Putin’s inner circle truly supports him...and who among those elites might be willing to help push him out.

One last thing to keep an eye on: Further semiconductor chip export curbs on China from the Biden Administration. Depending on how strict they are, the moves could make it even harder for China to obtain chips that enable advanced, Artificial Intelligence (AI) capabilities. That could hurt companies like NVIDIA (NVDA) and Advanced Micro Devices (AMD).