After a strong first-half-of-the-year finish on Friday, equities are a bit weaker in the early going today. Most other markets are flattish, including crude oil, gold, silver, and the dollar. Treasuries are a bit higher.

On the news front…

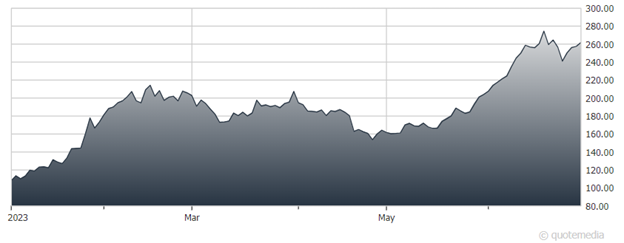

Apple (AAPL) managed to punch through the $3 TRILLION barrier as of Friday’s close. The tech giant became the first US company to trade at a market cap of more than $3,000,000,000,000, and is now sitting on year-to-date gains of just over 55%. Not too shabby.

As for the Nasdaq Composite as a whole, it surged 32% in the first half of the year. That was the index’s best H1 performance since 1983. It rose 37% that year, which came back when Apple was advertising a desktop computer named “Lisa.”

US-China relations are, well, not the best. But Treasury Secretary Janet Yellen is going to try to help with financial ties by traveling to Beijing for a four-day trip starting on Thursday. Expect officials to discuss investing ties, macroeconomic conditions, debt burdens, limits on tech exports to China, and more.

Meanwhile, China’s top-selling EV maker BYD Co. (BYDDY) reported selling just over 700,000 electric and hybrid vehicles in the second quarter. Competitor Tesla (TSLA) reported selling more than 466,000. Those volume figures were both records, and they sent shares of both companies higher in the early going.

Tesla (TSLA)