One of these days I’m going to wake up, see bond yields plunging, and stocks soaring. Today is not that day.

The same dynamic we dealt with throughout Q3 – higher rates, higher dollar, lower stocks – is playing out in the early going this morning. Crude oil, gold, and silver are all modestly lower, too.

On the news front...

The rise-and-fall of cryptocurrency brokerage FTX and former CEO Sam Bankman-Fried has captivated many on and off Wall Street in the past 18 months. Now, the 31-year-old is getting his day in court.

Jury selection begins today in federal court in Manhattan, and observers expect the trial to last a month and a half. Bankman-Fried has pled not guilty to the fraud and money laundering charges. But if he is convicted, he could go to jail for most or all of his life.

Oil prices remain elevated...and OPEC+ members are just fine with it. The cartel’s members are meeting this week, and they’re expected to stick with the production cuts enacted by Russia and Saudi Arabia earlier this year. Those are helping deplete global inventories, and keeping oil in the $90-per-barrel neighborhood.

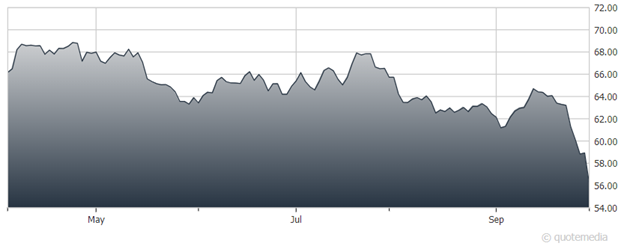

While the overall market was mixed yesterday, utilities got slaughtered. The Utilities Select Sector SPDR Fund (XLU) plunged 4.7%, the biggest one-day decline since the COVID-19 days of early 2020. The utilities sector has now underperformed every other S&P 500 group.

Utilities Select Sector SPDR ETF (XLU)

What’s driving the action? “Utes” are very sensitive to interest rates because they’re viewed as “bond substitutes. When rates rise as they have been, utilities usually perform poorly. Utilities are also strongest when the economy is heading toward or into a recession. With the economic data looking better lately, investors are moving out of Utes and into other groups.