Stocks are starting off the week on a strong note, while safe havens like Treasuries, gold, and silver are giving back some of Friday’s big gains. Crude oil and the dollar are slightly lower..

On the news front...

Israel is continuing to bombard targets in the Gaza Strip, but has so far not launched a ground invasion. Hundreds of thousands of Palestinians are evacuating southward, while the death toll there has climbed to more than 2,750. Israel updated its count of hostages taken by Hamas to almost 200.

The Wall Street Journal posed a great question in the headline of this article, namely “If the economy is so strong, why are consumer stocks tanking?” The piece goes on to note that shares of top retailers and consumer products companies are some of the worst-performing names in the S&P 500.

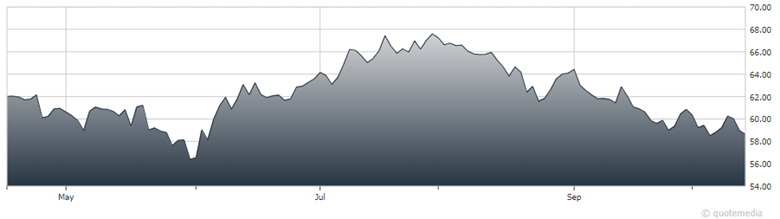

The SPDR S&P Retail ETF (XRT) is down 2% this year and 11% in the last two months. Meanwhile, the Consumer Staples Select Sector SPDR Fund (XLP) is off 9% and 10% in the same timeframe.

SPDR Retail ETF (XRT)

Sticking with that sector, the pharmacy chain Rite-Aid (RAD) has filed for Chapter 11 bankruptcy. It was done in by stiff competition from Walgreens Boots Alliance (WBA) and CVS Health (CVS), lawsuits related to opioid prescriptions, and years of losses. More than 2,100 stores will close and a significant number of its 47,000 employees will lose their jobs as part of its reorganization plan.