Tech stocks led a major comeback yesterday, with the Nasdaq Composite jumping more than 2% and the Dow Industrials even managing to flip into the green. Equities are giving back some ground this morning, though. Crude oil is higher, gold and silver are mixed, while Treasuries and the dollar are mostly flat.

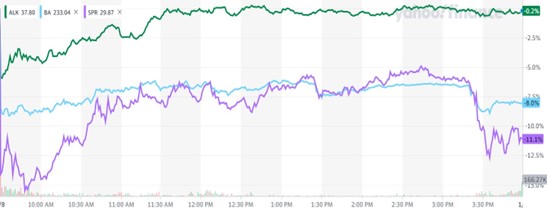

NTSB investigators are trying to figure out if door plug bolts failed to hold the piece of fuselage in place on Alaska Airlines (ALK) Flight 1282 – or if they were never installed in the first place. The door panel was found in a Portland, Oregon-area backyard, but it had no bolts attached. Shares of Boeing (BA) finished down 8% yesterday, while its 737 Max aircraft parts supplier Spirit Aerosystems Holdings (SPR) slid 11%. ALK finished roughly flat.

ALK, BA, SPR Chart (1-Day % Change)

We have a new global auto “king”: China. The country exported a record 5.26 million cars and trucks in 2023, surpassing long-time leader Japan. It shipped roughly 4 million vehicles in the first 11 months of last year. Ironically, the Russia-Ukraine war helped boost China’s fortunes because the country stepped into the void left by Western automakers who abandoned the country after fighting broke out.

Finally, Hewlett Packard Enterprise (HPE) could soon seal a deal to buy Juniper Networks (JNPR) for around $13 billion, according to the Wall Street Journal. If it happens, the transaction would expand HPE’s business in the communications network service and equipment space. JNPR is also pushing more aggressively into Artificial Intelligence (AI) with its Mist AI division.