Stocks are up modestly in the early going after a mixed day yesterday. Gold and silver are mixed along with Treasuries, while the dollar is largely unchanged.

Today is a bit of a “waiting with bated breath” kind of day on Wall Street. That’s because key inflation data for December comes out tomorrow and Friday, while Q4 earnings season kicks off Friday with big banks like JPMorgan Chase & Co. (JPM) and Bank of America (BAC) reporting alongside mega-cap health insurer UnitedHealth Group (UNH). But that doesn’t mean there aren’t a few stories worth mentioning.

It looks like SOMEONE was awfully eager to break the news of the Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs for trading. I say that because the SEC’s X (formerly Twitter) account was hacked, with someone putting up a fake post proclaiming SEC approval was a done deal.

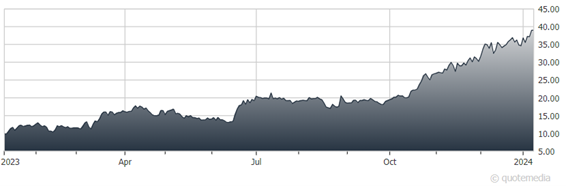

Grayscale Bitcoin Trust (GBTC)

The government is now investigating what happened, with X saying the SEC didn’t have two-factor authentication turned on for its account. Today is the day the SEC DOES have to rule, so we should get some news soon. In the meantime, non-spot Bitcoin investments like the Grayscale Bitcoin Trust (GBTC) have performed very well. It’s up 73% in just the last 90 days.

Finally, retailers are battling a wave of refund fraud, in part due to rule changes implemented in the wake of the COVID-19 outbreak. More than $100 billion in false returns got dumped in company laps last year, according to the National Retail Federation.

That number represented almost 14% of overall returns, double the level of shifty givebacks in 2020. Some consumers have resorted to sending back boxes of bricks, fake receipts, fake luxury goods, and more in an attempt to get undue refunds, something made easier when retailers relaxed online return policies during the pandemic.