Stocks slumped yesterday, but they’re hugging the flatline so far this morning. Crude oil is pulling back after breaking out Thursday, while gold, Treasuries, and the dollar are roughly unchanged.

Cash is piling up in money market funds – roughly $6.5 TRILLION, according to Crane Data, which tracks the industry. That’s up $150 billion just since the start of 2024. Many companies and individuals moved to money funds from deposit vehicles after a handful of banks failed just over a year ago. Plus, money funds offer higher yields now due to the Federal Reserve rate-hiking cycle...and banks have been relatively reluctant to pass the Fed's rate hikes on to depositors. That's fueling a substitution effect.

Some analysts say that “Wall of Cash” could move into stocks if markets keep rising and investors get “FOMO” (Fear Of Missing Out). But others say firms and individuals need to keep trillions of dollars in safer vehicles no matter what, with Barclays estimating that “FOMO fuel” is much lower at around $400 billion to $600 billion. Of course, that’s still a big number.

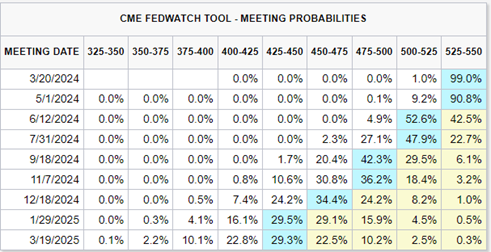

Speaking of the Fed, policymakers meet March 19-20 to decide their next moves. While they are virtually guaranteed NOT to cut at this gathering given recent higher-than-expected inflation numbers, they will share some guidance on the future direction of policy. Wall Street will be listening intently, trying to discern when the 5.25%-5.5% current rate range will start to fall.

What's Next for the Fed?

Three Cuts Starting in June/July?

Source: CME FedWatch Tool

As of TODAY, rate futures markets are putting the highest likelihood on three 25 basis point cuts in 2024. The highest-probability start time? Either the Fed’s June 11-12 or July 30-31 meetings, according to the CME FedWatch Tool, as shown above.

Finally, the Artificial Intelligence (AI) boom has produced billions in wealth for companies and investors alike. But the latest results from the graphics software company Adobe (ADBE) show not every firm is benefitting equally. ADBE shares slumped after disappointing quarterly results, with some analysts questioning whether the company was having trouble integrating and monetizing AI tech.