Stocks closed out last week on a weak note, but they’re trying to bounce back today. Crude oil is modestly higher again, while gold, silver, Treasuries, and the dollar are flattish.

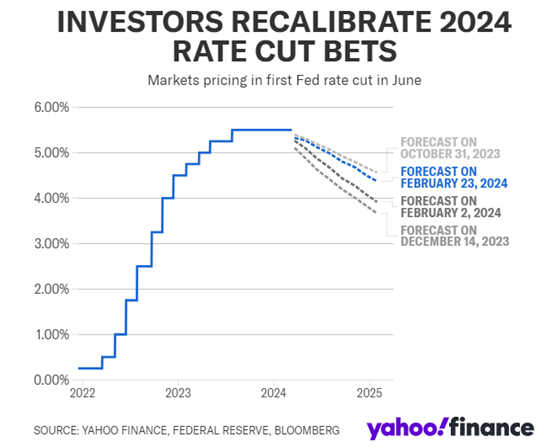

The Federal Reserve meets Tuesday and Wednesday to decide what to do next with interest rates. Markets don’t expect a cut this week, but they will be watching closely to see what the Fed says about the path for rates later in 2024.

So-called “dot plot” projections at the December meeting showed policymakers expected to cut rates three time this year. Investors will get updated projections Wednesday afternoon. The federal funds rate is currently 5.25% - 5.5%.

The Reddit Initial Public Offering (IPO) is also scheduled for Wednesday. The social media platform plans to raise as much as $748 million, and the deal is reportedly four to five times oversubscribed. Investors and insiders hope the company earns a valuation of around $6.4 billion, a solid number but below the 2021 peak of $10 billion. Should “RDDT” shares see strong demand, it could help ignite the moribund IPO market.

Higher gold prices are good for gold miners – even more so NOW than in the past. That’s because “hedging” activity is much lower these days. In the past, many mining companies locked in prices on their production using various financial instruments. So when prices rose, they didn’t reap the benefits.

In fact, many miners had to buy back their hedges at a loss. Barrick Gold Corp. (GOLD) alone spent more than $5 billion closing out its bad bets in 2009, while Newmont Corp. (NEM) coughed up $578 million in 2007. But the industry has only hedged about 192 metric tons of metal now, compared with 3,000 tons around the turn of the century.