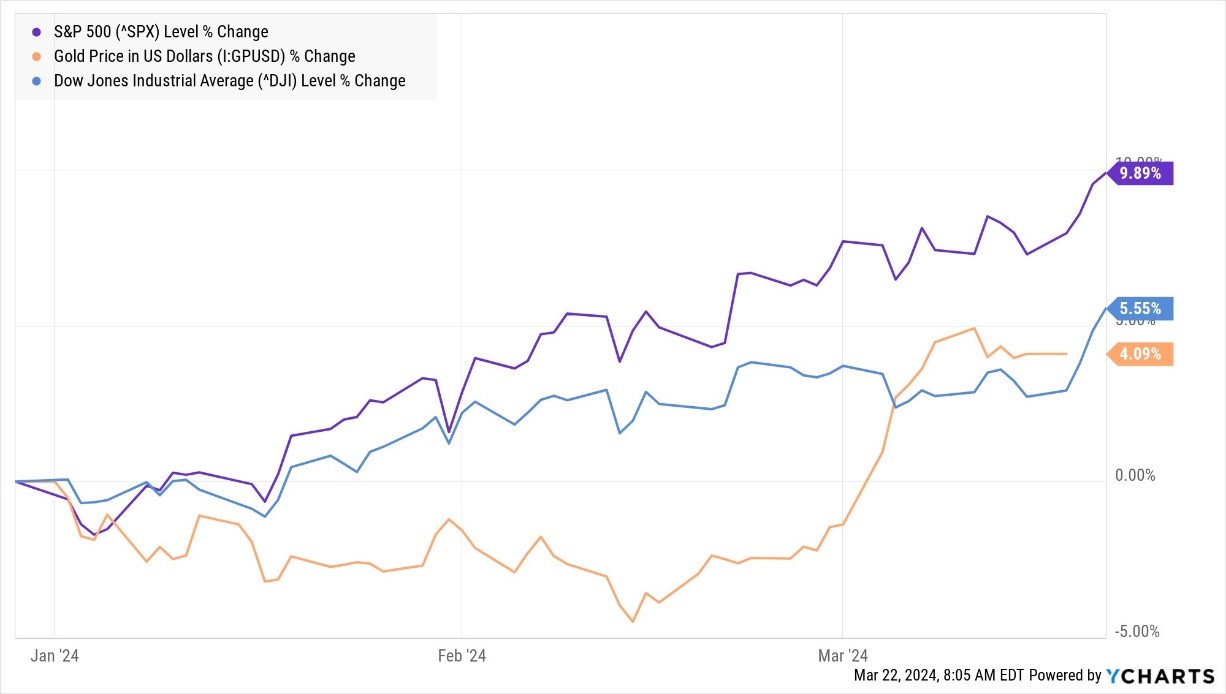

Remember that scene in the (original) movie Top Gun where Goose tells Maverick “We’re going ballistic”? That has basically been gold and stocks lately. The S&P 500 was recently up 2.4% in a week, while the Dow Jones Industrial Average is closing in on 40K. Gold surged above $2,200 an ounce before pulling back this morning.

In other markets, Treasuries are higher in price along with the dollar this morning. Crude oil is flat, while Bitcoin is lower and recently slipped under $65,000.

S&P 500, Dow Industrials, Gold (YTD % Change)

Data by YCharts

I’ve been calling this a “Be Bold” market since the start of 2023. Many of our expert speakers have shared ways to profit from it in technology stocks, in precious metals, and more. And those themes and ideas have been working. (Editor’s Note: You’ll get your latest chance to hear from our top contributors at the Investment Masters Symposium Miami, set for April 10-12. Click HERE to register.)

Then Wednesday, the Federal Reserve and Chairman Jay Powell poured gasoline on the fire. The Fed’s “dot plot” projections confirmed policymakers still expect to cut rates three times this year. Plus, they revised their GDP growth forecasts up without hiking their inflation expectations in kind. Higher growth WITHOUT higher inflation and WITH rate cuts is a perfect mix for assets like stocks and gold.

In other news, The US Justice Department joined with 15 states and Washington, DC to sue Apple Inc. (AAPL) for antitrust violations. The lawsuit alleges Apple took several steps with applications, cloud-based software, messaging, and more that essentially lock users into its ecosystem, raising consumer costs.

The smartphone and tech services giant said it would vigorously defend itself. But Apple shares lost more than $110 billion in value after the news broke. They’re down more than 7% now on the year, significantly underperforming the S&P.