After a late-day flop yesterday, stocks are seeing an early pop today. Gold is getting fired up, too, punching through $2,200-an-ounce again. Treasuries and the dollar are flat, while crude oil is off a bit.

It turns out the Singapore container ship that struck the Francis Scott Key Bridge issued a last-minute mayday call. That helped officials keep most vehicles off the bridge before it collapsed Tuesday morning. Sadly, six road workers on a night-shift job presumably perished.

Meanwhile, truck and ship traffic will be snarled for some time in the Baltimore area. Roughly 4,900 trucks traversed the Interstate 695 bridge per day recently, with $28 billion in goods making the crossing each year. Detours will add to delays and shipping costs. As for the Port of Baltimore, inbound shipments of cars and farm equipment will have to be re-routed, while US exports of coal will have to be diverted.

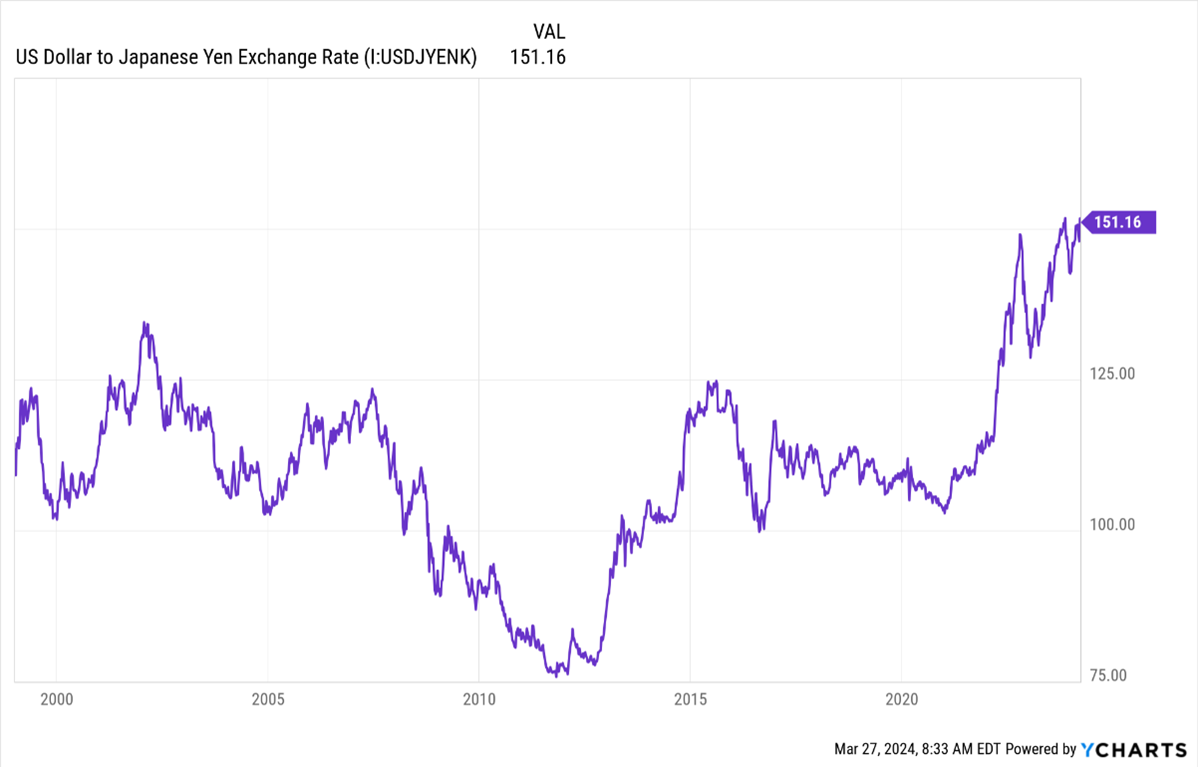

US Dollar Vs. Japanese Yen (USDJPY)

Data by YCharts

Most of the world’s central banks already raised rates sharply in the last two years, and are now looking to start cutting them gradually in 2024-2025. But the Bank of Japan dragged its feet so long, it only started raising rates from below zero this month.

That has left yields in Japan much lower than yields in the rest of the world, and caused the country’s currency to tank. The dollar just rose to 151.97 yen, a 34-year high. Investors are watching closely to see if Japanese officials intervene in currency markets to prop the yen up.

Finally, it looks like “Meme Stock Redux” for Trump Media & Technology Group (DJT), the money-losing social media company in which former President Donald Trump has a large stake. The firm is a product of a merger with a Special Purpose Acquisition Company (SPAC) called Digital World Acquisition Corp. It generated revenue of just $3.4 million, losing $49 million in the process, in the nine months through September. But shares skyrocketed when they began trading this week anyway, and the company is now valued at around $7.9 billion.