Investors headed into the weekend full of fear about what might happen in the Middle East. But while Iran fired more than 300 drones and missiles toward Israel, its defensive systems (and allied nations) managed to shoot down almost all of them before they could cause any harm.

Israel has not yet launched any retaliatory strikes, so many “safe haven” trades are being reversed. More specifically, stocks are bouncing, crude oil is falling, and Treasury yields are rising. Gold and silver are hanging on to most of their recent gains, however, while copper is continuing to rally.

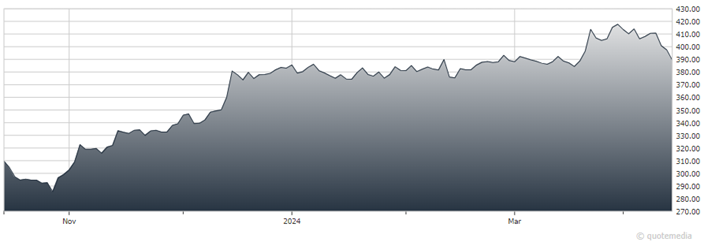

Goldman Sachs Group Inc. (GS)

The first round of “Big Bank” earnings from late last week left something to be desired. But Goldman Sachs Group Inc. (GS) hit the ball out of the park with Q1 profit, earning $4.13 billion, or $11.58 per share, on revenue of $14.21 billion. The numbers trounced estimates, with strong performance in its fixed income and investment banking divisions boosting results. GS shares rose in early trading.

Americans’ penchant for spending freely carried over into March, with retail sales rising 0.7%. That was more than double the 0.3% gain economists expected. February figures were revised higher, too. Among the other important economic releases this week are housing starts tomorrow and existing home sales on Thursday. More Federal Reserve speakers will also weigh in on growth and inflation in the coming days.