Stocks popped yesterday...then flopped hard into the close. They’re trying to bounce again in the early going today, however. Gold and silver are mixed, crude oil is a bit lower along with Treasuries, and the dollar is flat.

Markets, Middle East citizens, and global diplomats and politicians remain on edge today, waiting to see if and how Israel will react to Iran’s weekend missile and drone attack. Many are urging restraint, especially because the defensive efforts of a coalition of nations and Israel itself proved almost 100% successful in preventing damage, injuries, and deaths. But several options are still reportedly on the table.

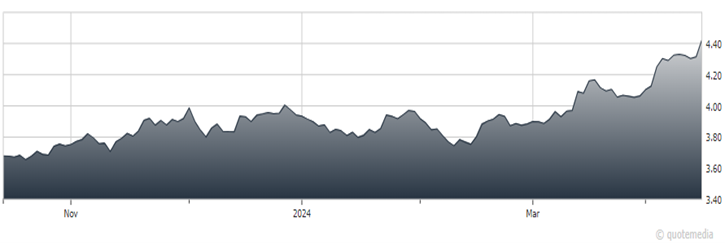

Copper Futures

Meanwhile, the recent metals rally hasn’t just been contained to precious ones like gold and silver. Copper has been on fire, too. Futures prices are up 15% in just the last three months, recently hitting a 22-month high. As a matter of fact, semi-processed copper ore (called concentrates) is trading for roughly the same price as copper itself – an odd situation brought about by serious supply concerns, according to Bloomberg.

Finally, the Q1 earnings onslaught is continuing. Bank of America Corp. (BAC) reported a mixed bag of good and bad data. Johnson & Johnson (JNJ) missed forecasts on disappointing sales of its psoriasis drug Stelar. Health insurance giant UnitedHealth Group Inc. (UNH) topped estimates, despite a big $1.4 billion charge related to a cyberattack that targeted its Change Healthcare division.