Stocks rallied broadly yesterday, though they’re mixed in the early going today. Gold and silver are modestly weaker again along with crude oil. Treasury prices are falling, while the greenback is up a bit.

Tesla Inc. (TSLA) has been the worst-performing, former “Magnificent Seven” stock. But it jumped more than 11% in the after-hours session yesterday and it’s rallying this morning, too. The catalyst: Even as Q1 earnings and revenue missed analyst forecasts, CEO Elon Musk promised to launch less-expensive vehicles earlier than expected.

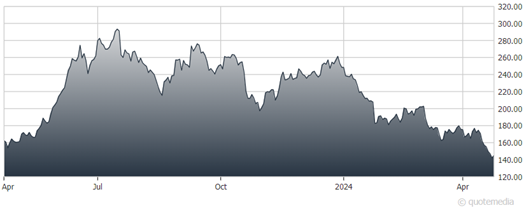

Tesla Inc. (TSLA)

A “Model 2” car priced under $30,000 could help Tesla reignite demand in the intermediate term. That, in turn, would keep bringing in cash to fund Musk’s longer-term goals like the creation of a robotaxi business.

The Boeing Co. (BA) has come under fire from customers and regulators after a series of manufacturing issues and the Alaska Air Group Inc. (ALK) fuselage failure accident that could have been catastrophic. Now, investors are seeing the impact on BA’s top and bottom lines. The company lost $355 million, or $1.13 per share, in the March quarter. Revenue sank 8% from a year ago to $16.6 billion, while commercial airplane deliveries plunged 36%.

Finally, the struggles of the Japanese yen that I wrote about recently keep intensifying. The dollar rose past 155 yen in the last 24 hours, its highest since June 1990. The move doesn’t just impact currency traders. It could also help drive US interest rates higher and lead to increasing global trade and political tensions.