Stocks posted modest gains yesterday, but they’re showing modest losses in the early going today. Gold and silver are pulling back along with crude oil and Treasuries. The dollar and Bitcoin are up a bit.

The Artificial Intelligence (AI) / chipmaker / technology sector giant Nvidia Corp. (NVDA) reports earnings today after the closing bell. Officially, Wall Street is looking for $13.1 billion in profit on $24.6 billion in sales for the fiscal first quarter. But investors are hoping NVDA beats those numbers AND issues bullish guidance going forward to keep this stock market rally going. NVDA shares are trading right up against old highs/resistance around $950-$955.

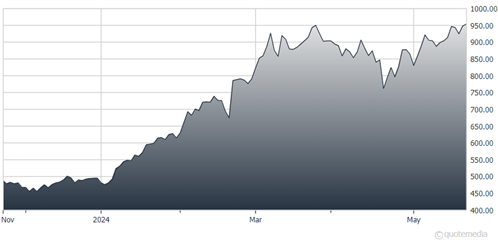

Nvidia Corp. (NVDA)

In my Chart of the Week piece in this Monday’s Trading Insights newsletter, I wrote about how the credit markets are NOT signaling concerns about the ability of risky borrowers to pay off their debts. I highlighted that the extra yield “spread” on high-yield (or “junk”) bonds over underlying Treasuries has been narrowing for more than a year now.

Now, the Wall Street Journal is chiming in on the same topic, publishing a story headlined “Risky Bonds Join the Everything Rally.” The piece notes that investors have thrown $3.7 billion in net new money at junk bond funds in 2024. That’s the first time we’ve seen inflows like that since 2020. Junk borrowers have taken advantage of the increased investor appetite to issue $131 billion in high-yield bonds through May. That’s up 84% from a year ago. “Be Bold” indeed.

Finally, China's aggressive export policy is raising hackles in the US and other developed economies. But tariffs and product restrictions aren’t stopping the nation from flooding some world markets with inexpensive Electric Vehicles (EVs), including those from BYD Co. (BYDDY). The firm overtook Tesla Inc. (TSLA) as the biggest global EV company in late 2023, and its new Seagull hatchback should hit European markets in 2025.